Google ties up with Indian banks to launch digital loan solutions

It aims to offer instant pre-approved loans to its app users.

Reuters reports that Google is forging partnerships with four Indian banks namely Federal Bank, HDFC Bank, ICICI Bank and Kotak Mahindra Bank with the goal of bringing quick and pre-approved loans to the growing userbase of its app.

Also read: Indian banks embrace AI to drive costs down

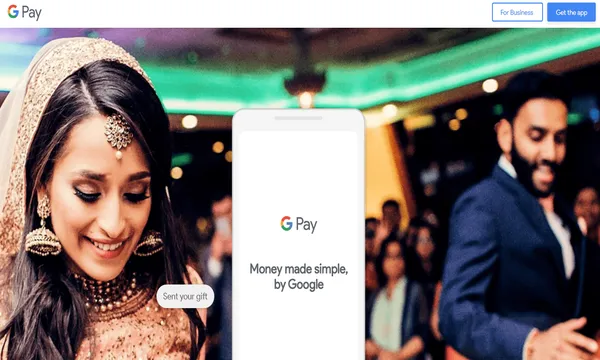

Google earlier launched its payment app Tez which it then rebranded as Google Pay last year as it aims to capitalise on the nation’s digital payments space which is expected to grow five-fold from $200b to $1t by 2023.

At an annual Google event in New Delhi, Caesar Sengupta, the vice-president of Google’s Next Billion Users initiative and its Payments said the move would make banking services accessible to tens of millions of Indians.

Also read: APAC fintech market to be worth $72b by 2020

Over 55 million people in over 300,000 towns and villages across the country have downloaded the payment app to pay for bus rides and dinner bills, amounting to nearly $30b in annual transactions.

Here’s more from Reuters:

Advertise

Advertise