Singapore banks' fixed deposit rates to maintain sustained easing

FD rates have already started tapering off in April.

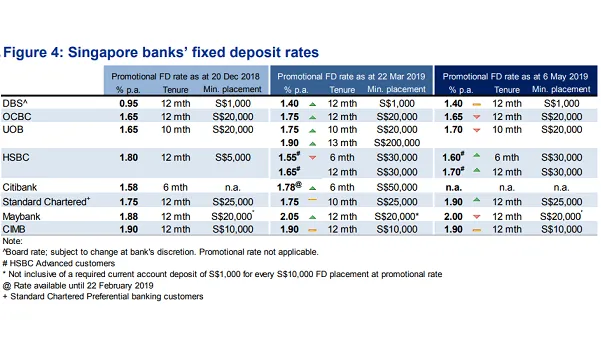

The fixed deposit (FD) rates of banks in Singapore is expected to continue moderating in the coming months in a sign that funding pressures may have already peaked, according to a report from CIMB.

FD rates have grown from around c.1.4% in January 2018 to c.1.9% in December 2018 although most of the higher FD rates in the market came from foreign banks which had the push of fulfilling required net stable funding ratios.

"[T]hese promotions were largely offered by foreign banks in Singapore, which had much smaller deposit franchises here compared to the listed Singapore bank," analyst Andrea Choong said in a report.

FD rates have already started to ease in April which bodes well for banks who can expect milder increase in funding costs in a move that is expected to help boost net interest margins.

Advertise

Advertise