StanChart consortium unveils Hong Kong virtual bank Mox

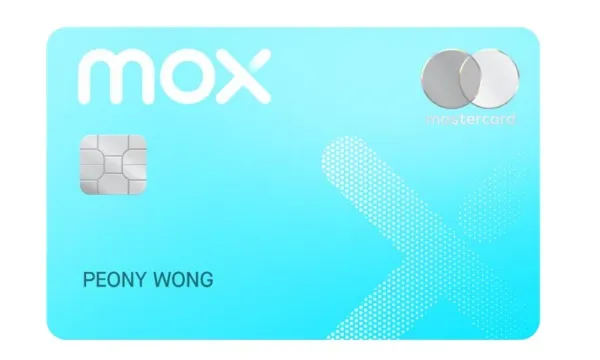

It will launch Asia’s first numberless bank card when it launches later this year.

Standard Chartered, in partnership with PCCW, HKT and Trip.com, has launched the virtual bank Mox in Hong Kong, an announcement revealed.

Mox represents a plethora of meanings such as “mobile experience”, “money experience”, “exponential growth”, amongst others, which reflects the endless opportunities the bank hopes to create.

As its first project, the bank is launching Asia’s first all-in-one numberless bank card. It comprises a physical card for both spending and ATM cash withdrawals without any printed card numbers, expiry date, or card verification. All card information can instead be accessed by a Mox app.

Customers will receive a Mox Card when the bank launches to the public later this year, the release added. Mox is currently in beta testing stage.

Advertise

Advertise