Retail Banking

Land Bank of Taiwan secures license to operate in Australia

Land Bank of Taiwan secures license to operate in Australia

It can operate as a foreign authorised deposit-taking institution.

Luxembourg’s Banking Circle to buy Australian Settlements Ltd.

ASL provides settlement and payment services in Australia.

Japanese banks’ total assets at $9.15t in Nov 2024

Banks hold $1.52t in assets overseas.

Vietnam's banking system poised to achieve 16% credit growth: SBV

The growth targets for credit institutions will be determined based on their 2023 ratings.

Embracing Change and Capturing Opportunities with Insights from Leading Chinese Banks

Banking Reimagined: Embracing Change and Capturing Opportunities with Insights from Leading Chinese Banks.

Malaysian banks’ earnings growth to moderate from slower NII growth

Loan growth is expected to recover thanks to more business loans.

BDO names Jeffrey Alejandro as chief audit executive and IAG head

He worked for ING Bank NV and Citibank NA previously.

UnionBank names Vivian Perez as financial risk and performance head

The appointment was effective 2 January 2025.

Thai banks’ Q4 profit slated for 20% growth with portfolio cleanup

Kiatnakin Phatra Bank, Tisco may see a rise in credit costs, an analyst said.

Sri Lanka and Vietnam banks to boost 2025 financials

Sri Lanka’s political crises are receding; Vietnam will be lifted by higher loan growth

Philippine banks’ costs to rise; Singapore lenders face slower profit growth

Singapore banks’ net interest margins have already peaked in 2024.

Bangladeshi banks’ weak profitability to continue in 2025: analyst

Asset quality will be challenged by weak lending standards and foreclosure laws.

Asian banks face profit strain in 2025

Falling interest rates could heighten some lenders’ appetite for risk.

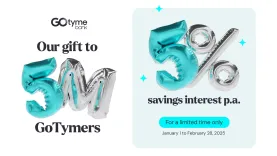

GoTyme Bank reaches 5 million users in 2024

The bank is aiming to reach 9 million customers by end-2025.

Ant Int’l sees growth in 4 divisions, Alipay+ holds 1.6 billion users

Cross-border transactions processed via Alipay+ tripled year-on-year in 2024.

Panin Bank acquisition could boost DBS, OCBC profits

A full acquisition could increase fiscal year 2025 PATMI by 2% to 3%.

Hong Leong Bank reimagines branches for digital era

The lender sees itself as a digital bank with a physical presence.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership