Staff Reporter

Indonesia’s Jalin targets payment fraud with BPC tie up

Indonesia’s Jalin targets payment fraud with BPC tie up

Jalin will expand its utilisation of BPC tech for real-time fraud monitoring.

Korean banks’ loans contracted in December as banks guarded capital ratios

SME loans fell as banks slowed down lending for their capital adequacy ratios.

Philippine bank lending rose 10.3% on business, consumer loans

Outstanding loans to consumers grew at a slower rate, however.

HSBC mulls $1b Singapore insurance exit, report says

It could be valued at over $1b.

Crédit Agricole CIB names Yang Zhang as head of cash and trade sales for APAC FIs

She will oversee business development and origination of cash management.

Natixis CIB names Jarek Olszowka as APAC head of green & sustainable hub

He was the international head of sustainable finance for a major Japanese financial services group.

Ant Int'l processed 2 billion payments in key emerging markets in 2025

Its Alipay+ platform now connects over 1.8 billion users across 100 markets, it said.

Citi hires NAB, CBA bankers for Australia syndication team

Jessica Rowe joins from NAB whilst Dane Harris joins from CBA.

DBS Hong Kong unveils new SME sustainable finance program

Eligible uses include energy efficiency upgrades, resource conservation, and clean transportation.

APAC Islamic banking rebound in 2026 set to mask market divides

Growth trajectories will differ across key markets.

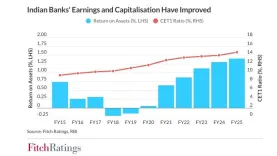

Indian banks hit decade-high returns but profit set to soften

Some of the more recent reforms are untested through a down-cycle, said Fitch.

Weekly Global News Wrap: Trump floats 10% card rate cap; Citi to cut 1,000 jobs

And Credit Agricole wins ECB approval to lift Banco BPM stake above 20%.

Taiwanese domestic banks’ SME loans rise to $341.94b in November

Loans extended to SMEs by domestic banks account for 64.7% of total loans.

BSP extension lets banks write bigger green loans beyond 25% cap

Banks can exceed the single borrower’s limit by an additional 15%.

Southeast Asia fintech funding fell 21% in 2025

This is despite Airwallex and Superbank doing well in their fund raising and IPO.

Taiwan banks add $6.69b loans in November as bad debts tick up

The average NPL ratio is 0.16% with bad loans rising by $0.06b.

Singapore Gulf Bank gains access to J.P. Morgan’s USD clearing network

The bank can receive and credit clients’ incoming funds over weekends and holidays.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership