Staff Reporter

Dah Sing Bank launches multi-currency debit card for SMEs

Dah Sing Bank launches multi-currency debit card for SMEs

It enables overseas payments across 11 currencies with no foreign currency transaction fees.

Fintech Fingular secures $10m credit line for Malaysia expansion

The funding will also be used to strengthen operational capacity.

Security Bank names new wealth segment head

The Philippine bank also announced the retirement of EVP Gina Go.

RCBC names AREIT CEO as independent director

Independent director Erika Fille Legara has been named to the advisory board.

OCBC opens client stocks to institutional borrowers via Citi platform

The securities lending market generated $1.2b of revenue in December 2025 alone.

Discover the future of financial services with Smart Communications

Explore how Smart Communications can help financial institutions balance compliance and personalisation, and accelerate transformation.

Hang Seng Bank delists from Hong Kong Stock Exchange

Registered shareholders to receive payment via bank transfer or cheque.

WeLab Bank kills FX fees with multi-currency debit card

The new Mastercard allows spending in 11 currencies at "at-cost" prices.

Indian banking returns hit decade-high as global margins shrink

CareEdge report confirms banking metrics are the strongest in years with multi-year low debt ratios.

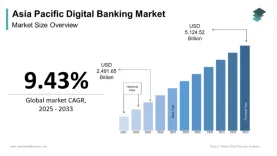

APAC digital banking market to hit $5.12t by 2033

Market Data Forecast projects a 9.43% CAGR through the next decade.

BPS Financial fined $9.67m over Qoin Wallet crypto promotion

It is also hit with a 10-year ban for making unlicensed services.

China Bohai Bank faces high asset risk from retail and investment loans

Its NPL ratio rose 5 basis points in June 2025 compared to six months prior.

Kiatnakin Phatra Bank's profit jumps 26.1% but loan book shrinks in Q4 2025

Its net profit of $190.06m is 18.6% higher compared to a year earlier.

India’s ESAF Small Finance Bank modernises onboarding and lending

It expects to optimise IT costs and see lower licensing costs.

Indonesia's Artajasa ties up with Ant International on cross-border payments

Artajasa connects over 80,000 ATMs and 41 million merchants in Indonesia.

CZBANK stays stable but property risks spark new NPL threat

Net interest margin narrowed in 9M 2025, but this is expected to slow, Moody’s said.

HSBC gains court sanction for Hang Seng Bank privatisation scheme

Capital reduction clears path for planned Hong Kong delisting

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership