Staff Reporter

Macquarie Bank launches new AI-powered chat agent

Macquarie Bank launches new AI-powered chat agent

It can answer common customers' questions and requests and escalate to a team member.

Siam Commercial Bank to perform maintenance on international fund transfers

SCB Easy App users will not be able to use the service during this period.

Digital transformation starts with leadership

When employees understand the “why” behind a change, digitalisation becomes a shared journey rather than a top-down mandate.

Singapore bank wealth fees surge 44% to defy NIM squeeze

Overall fee income is expected to expand at a double-digit rate of 31% this quarter.

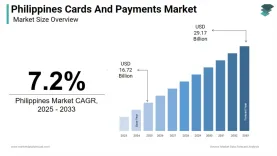

Philippine payments market to hit $29.17b by 2033

The report places 2025 value at $16.72b and tracks a climb from 2024 baseline levels.

Intelligent Inclusion, Sustainable Profitability: Asian Banking & Finance and Insurance Asia Summit Returns March 10 to the Philippines

Leading industry figures from BSP, BPI, Singlife, BDO, Malayan Insurance, and Allianz PNB Life assemble to discuss risk management, data-driven personalisation, and other key issues.

OCBC profit expected at $1.7b on higher fee and insurance income

Fee income and insurance contribution are expected to have grown during the quarter.

UOB profit set to slide 16.7% on lower wealth and loan fees

It will take time for UOB to return to its peak profitability, the report said.

CMB seen as top winner in China’s wealth reallocation, CGSI says

CGSI expects the bank to benefit from stronger demand for wealth management and bancassurance products.

Hong Kong expands RMB facility to $28.6b after banks hit quotas

The initial quota had been fully allocated to 40 banks.

Bangkok Bank’s net profit up 1.8% to $1.47b in 2025

For the full year, expected credit losses amounted to $1.16b.

Krungsri’s profit rises 6.9% in 2025 as retail and SME loans contract

Its CEO warned of slower economic growth and consumption in 2026.

Mizuho and Fujitsu automate 70% of SME order processing tasks

It streamlines 70% of order processing tasks by elimination manual input and conversion work.

Citi foresees more Asia M&A deals on healthcare and multinational moves

In 2026, Citi already led two M&A biopharma deals in China.

Grab launches iPhone tap-to-pay feature

Merchants can accept contactless cards without POS hardware.

SCB X’s net profit rose 8.1% to $1.51b in 2025

But its loan portfolio contracted and net interest income dropped 8%.

Mega ICBC's problem loans may rise on SME and tariff risks: Moody’s

The bank’s foreign currency loan portfolio may benefit from higher USD lending margins, however.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership