Frances Gagua

Thailand’s Krungsri teams up with Klook to elevate position in travel market

Thailand’s Krungsri teams up with Klook to elevate position in travel market

Exclusive privileges will be offered to the bank’s customers.

Weekly Global News Wrap: Citi to cut 20,000 jobs in two years; Spain’s BBVA expects higher dividend payout

And crypto firms in UK are introducing new risk assessment and profile tests ahead of stricter regulations.

Hong Kong’s Bank of East Asia inaugurates tower in Qianhai

It will serve as the bank’s strategic hub in the Greater Bay Area.

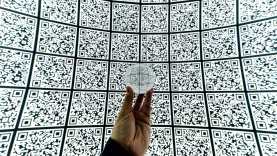

Krungsri launches cross-border QR payments to Hong Kong

Travelers need only to pay using the KMA krungsri app.

BRI’s BRImo app now has 30.4 million users

There were only 2.9 million users in 2019, in comparison.

BDO to issue $89.2m in fixed-rate sustainability bonds

It has a tenor of 1.5% years and a coupon rate of 6.025% per annum.

Maybank Investment Bank COO Tengku Ariff Azhar Tengku Mohamad named OIC

This is until a new CEO is appointed.

Mastercard on why biometrics is the future of secure payments

Today it’s a finger tap, tomorrow you may only need your face to pay, says Mastercard’s Karthik Ramanathan.

1 in 3 Singaporeans use digital investment apps

There is a desire in the local population to increase private wealth, says UnaFinancial.

BPI doubles GCash e-loading fee

GCash loading via ECPay fee will be charged PHP10 starting March.

Malaysia’s Alliance Bank opens new branch in Saradise Kuching

The branch has launched exclusive offers to commemorate the launch.

South Korea to fine two global investment banks for naked short selling: report

The two banks made five naked short selling orders between 2022 and 2023.

Singapore now has S$3.2b in funds ‘locked’ to prevent scams: ABS

Around 38,000 accounts now make use of local banks’ money lock feature.

Boost-RHB digital bank clinch official approval to commence operations

Boost Bank aims to pave the way for a new era of embedded finance

Vietnam fintech funding plummets 84% in 2023

For the second year in a row there were no late-stage funding rounds.

Expect ‘stagnant’ Chinese structure finance market in 2024: S&P

Issuance momentum of dominant segments will reportedly remain slow.

37.6 million credit cards active in Taiwan in November: FSC

The number of cash cards remained the same as in October, however.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership