New Zealand card payments market to be valued $67.1b in 2026

On average, each NZ individual holds over three cards, GlobalData found.

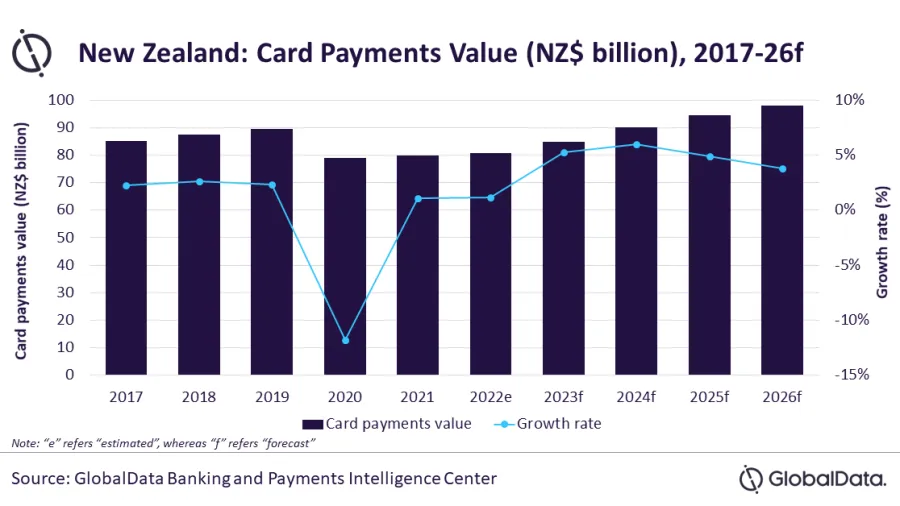

New Zealand’s card payments market is expected to grow by a compound annual growth rate of 5% between 2022 and 2026 and reach $67.1b (NZ$98b) in 2026, according to forecasts by data and analytics company GlobalData.

Total value of card payments dropped 11.8% in 2020 due to the COVID-19 pandemic, and registered a slow growth of 1.1% in 2021 to reach $54.6b (NZ$79.7b).

ALSO READ: Buy Now, Pay Later firms' credit losses on the rise

Data from Payments NZ revealed that 62% rise in contactless card transactions between 2018 and 2020. The share of contactless payments in total card payments increased from 24% in 2018 to 39% in 2020.

As of 2021, each individual in New Zealand holds over three cards, according to Ravi Sharma, lead banking and payments analyst at GlobalData. Outside of cards, there is a rising preference for contactless payments in the country, Sharma further observed.

In contrast, ATM cash withdrawals have reduced by 20.9% and 5.9% in 2020 and 2021, respectively, a trend that is expected to continue in 2022.

Advertise

Advertise