Buy now, pay later gains traction in Asia

BNPL brand Afterpay served 20 million customers in Australia alone.

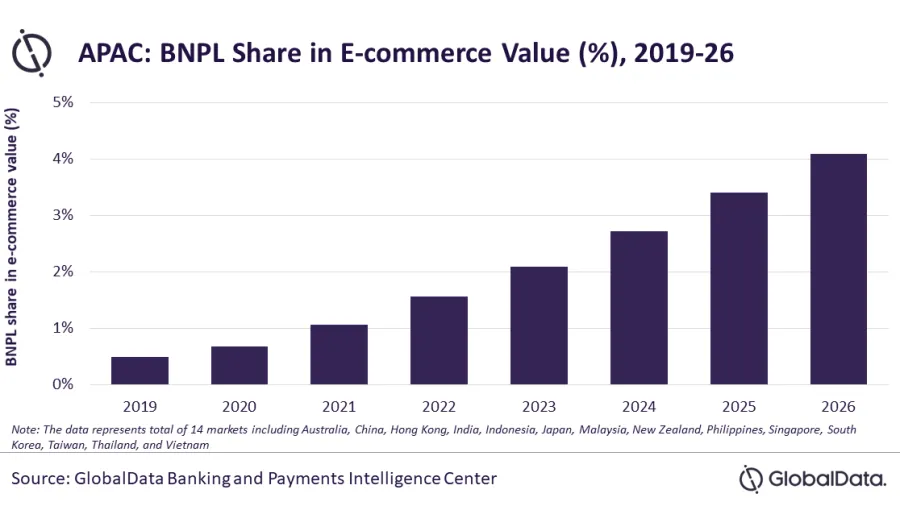

Buy now, pay later or BNPL will account for 4.1% of the share of e-commerce payments value in Asia by 2026, reports data and analytics firm GlobalData.

In 2022, the alternative payments option reportedly accounted for 1.6% of all e-commerce payments in the region.

The COVID-19 pandemic and the recent surge in inflation has led to increase in demand for short-term financing, GlobalData reported.

“As a result, BNPL has emerged as a viable payment option for consumers, who do not have access to traditional credit options such as a credit card, allowing them to pay for purchases conveniently at later dates in installments,” the report said.

ALSO READ: Buy Now Pay Later gains traction in Australia

In particular, the service is thriving in Australia and New Zealand. BNPL makes up 20% of all e-commerce transactions in Australia, and 12.5% in New Zealand. Afterpay, Australia’s leading BNPL brand, served over 20 million customers as of end-2022.

Other Asian markets are also catching up, such as in Singapore, Japan, and India, GlobalData said.

“The use of BNPL services is poised for high growth in Asia with consumers shifting to online shopping and growing number of online merchants accepting BNPL brands,” said Shivani Gupta, senior banking and payments analyst, GlobalData.

Advertise

Advertise