AI Governance: Navigating the Balance Between Innovation and Ethics

By Rupanjan MukherjeeAs AI becomes prevalent in various spheres of business, the need for governance around it becomes critical.

Imagine walking into the local branch of your bank and being greeted by an interactive AI on a virtual screen that knows your financial history.

With just a few taps or by briefly analyzing your needs, the AI swiftly processes your banking relationship or identifies you as a new client, offering you a tailored response within seconds.

The interaction seems organic, like having a real-life conversation with a qualified financial advisor and enables you to get your questions answered in the quickest manner possible.

This is not something that is far-off in the future anymore; it's rapidly becoming a reality as generative AI technologies evolve at an unprecedented pace, capable of handling increasingly complex inquiries in mere moments.

As AI becomes prevalent in various spheres of business, the need for governance around it becomes critical. Like a "GPS" that is used to navigate a self-driving car, AI governance helps us get to a destination safely by showing us the routes to avoid.

In finance, this translates into a systematic approach of principles, policies and practices overseeing the creation, utilization and management of AI systems.

AI applications today

As AI reinvents the financial realm, we face crucial questions: How can we leverage the power of this technology while ensuring its ethical and responsible use? What steps should be taken to ensure strong oversight across various digital platforms?

Let’s first look at where AI has been applied and the potential pitfalls. In algorithmic trading, thousands of trades can be executed with artificial intelligence in seconds. Left unchecked, they can disrupt or even manipulate the market.

Stringent AI governance needs to be in place within trading systems to avoid incidents like the 2010 'Flash Crash', which saw a rapid fall in the stock market due to automated algorithmic trading.

Credit decisioning is another area where AI governance is crucial.

AI models are increasingly trained to determine creditworthiness. However, if these models are trained on historically biased data, they could perpetuate or even exacerbate existing inequalities.

This isn't just a theoretical concern – in 2019, a major tech company faced scrutiny when its credit card algorithm allegedly offered lower credit limits to women compared to men with similar financial profiles.

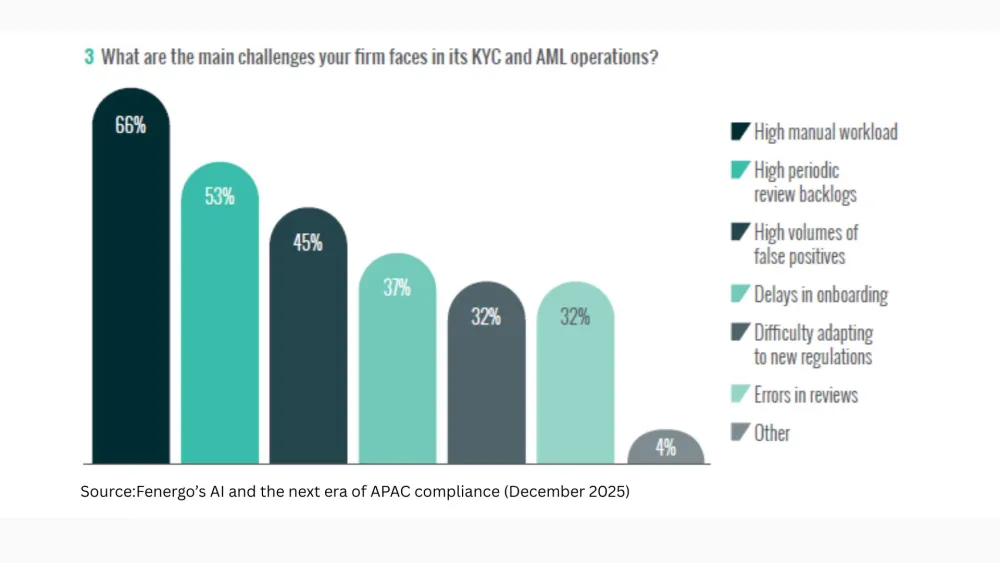

Even in fraud detection, where AI excels at identifying unusual patterns, governance is key. Without it, we risk false positives leading to legitimate transactions being blocked, frustrating customers and potentially damaging the bank's reputation.

The stakes are high. According to a 2022 survey by Baker McKenzie, only 4% of C-suite respondents perceived AI risks as significant, and less than half indicated having AI expertise at the board level.

In another study, they found that 91% of financial services companies have incorporated AI tech into their operations in some capacity, but only a modest fraction has established a robust AI governance framework.

This gap presents significant risks, not just to individual institutions, but to the stability of the entire financial system.

AI governance mitigates risks by ensuring transparency, explainability, and accountability in decision-making processes, promoting fairness and safeguarding data privacy and security.

These practices not only maintain customer and regulatory trust but also comply with legal requirements like General Data Protection Regulation and California Consumer Privacy Act, that are particularly crucial in handling sensitive financial data.

Developments in AI governance

Regulators and industry players are looking into plugging the gap between AI implementation and governance.

For example, the European Union has proposed the AI Act, a comprehensive regulatory framework aimed at ensuring the safe and trustworthy development and use of AI systems. This act proposes a risk-based approach, with stricter rules for high-risk AI applications in finance, such as credit scoring and loan approval systems.

Within the financial sector, frameworks, such as the AI Ethics Framework developed by the Bank for International Settlements, are providing guidance, emphasizing on principles such as fairness, transparency, and accountability.

Forward-thinking financial institutions are adopting a range of practices such as bias testing, model interpretability, and continuous monitoring of AI system performance to identify and mitigate unintended consequences.

Principles-based approach

Effective AI governance in finance needs to balance innovation with regulation, enabling the industry to advance while protecting the interests of customers.

To do so, a principles-based approach to governance should be adopted, establishing flexible ethical guidelines. Robust bias detection and mitigation strategies, including diverse data collection and regular audits, are crucial.

Prioritizing explainable AI models and investing in explanation techniques can enhance transparency.

Finally, a 'privacy by design' approach should be implemented to safeguard sensitive financial data. These will foster responsible AI use while maintaining innovation in the financial sector.

Citi recognizes that AI can significantly enhance operational efficiency and customer engagement, and is committed to implementing AI in a safe and responsible way.

For example, AI systems rely heavily on data, which gives rise to the need for robust data governance frameworks. This includes ensuring data quality, security, and compliance with regulatory standards. The bank's governance strategies are designed to address the challenges posed by the vast amounts of data generated and used in AI applications.

The bank has also implemented stringent governance measures, including a comprehensive review and attestation system, to ensure thorough evaluation and proper registration of AI models across all critical business processes.

Dedicated task forces conduct independent assessments of both technological viability and business rationale for all submitted generative AI proposals. Chosen applications undergo a meticulous screening process to establish appropriate levels of explainability, observability, and transparency – fundamental components of a robust AI governance framework.

The financial sector plays a crucial role in shaping our economy and society. By leading the way in responsible AI use, the finance industry can set standards to influence AI governance across other sectors.

The path forward will not be easy. It will require ongoing dialogue, collaboration, and a commitment to continuous learning and adaptation. But the stakes are too high to ignore.

By embracing robust AI governance now, we can help ensure that the financial sector of the future is not only more efficient and innovative but also more fair, transparent, and trustworthy.

The future of finance is AI-powered. It's up to us to ensure it's also ethically grounded.

Rupanjan is the head of digital growth governance and controls at Citibank Singapore Limited.

Advertise

Advertise