Trust Bank gamifies new goal-based saving feature

It allows users to set personalised savings targets and manage up to five pot.

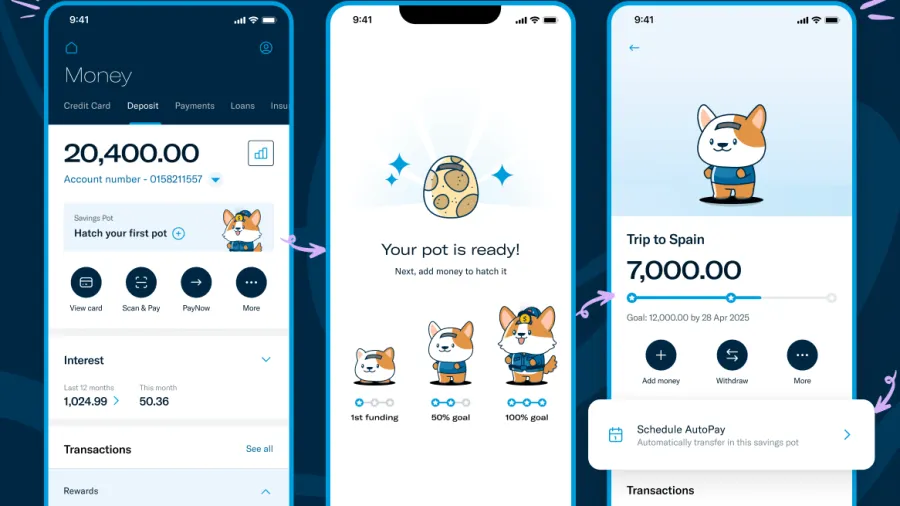

Trust Bank has introduced its new Savings Pots feature, designed to help customers automate and simplify their saving habits based on specific financial goals.

Since its recent launch, customers have created over 75,000 Savings Pots, with popular categories including emergency funds, travel, and home ownership.

The feature allows users to set personalised savings targets and manage up to five pots simultaneously.

Through Trust’s enhanced AutoPay feature, customers can automate recurring top-ups, choosing the amount and frequency without the need for manual intervention.

Funds in Savings Pots enjoy the same interest rates as a Trust Savings Account, with no minimum deposit, lock-in period, or withdrawal penalties.

As an added incentive, Trust has gamified the experience by introducing five digital characters—a lion, cat, dog, otter, and monitor lizard—that hatch and grow alongside the user’s savings progress.

Evonne Low, head of Deposits & Payments, said the initiative simplifies saving whilst encouraging users to build healthy habits.

Aditya Gupta, Chief Product Officer, emphasised that Savings Pots were developed using customer feedback to make saving “easy, automated, and rewarding.”

Advertise

Advertise