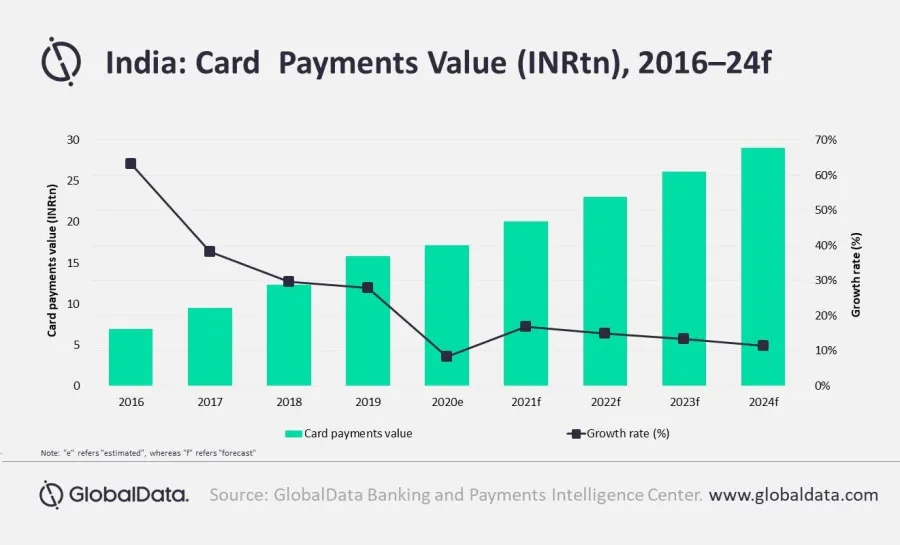

Chart of the Week: Lockdown easing drives card payments recovery in India

Fear of COVID-19 spread is driving consumers towards digital payment tools.

The value of card payments in India is estimated to grow 8.4% in 2020 and grow at a compound annual growth rate (CAGR) of 14.1% between 2020-2024 to reach $408.1b (INR29.1t), according to a report by analytics firm GlobalData.

The fear of COVID-19 spread through handling of cash is driving consumers towards digital payment tools. According to the Reserve Bank of India, the number of cash withdrawals declined by almost 50% in the April 2020, compared to the previous month.

Consumer spending is expected to rise now that the country has entered the unlock phase and is gradually easing restrictions. This will provide a much needed push to affected sectors like tourism, hospitality, and retail, which in turn will benefit the payments market, according to Nikhil Reddy, banking and payments analyst at GlobalData.

Meanwhile, lingering caution on cash as a result of pandemic-related fears is projected to accelerate the shift towards a cashless mode of payment, said Reddy.

“India has traditionally been a cash-based economy. The current COVID-19 outbreak will act as a catalyst to accelerate the shift towards cash-less payments in the country, which is already riding the digital wave since government’s demonetization move way back in 2016,” he added.

Advertise

Advertise