Transforming IFRS 9 Compliance: The Case for Expectation-based Subledger Accounting

The introduction of IFRS 9 at the start of 2018 fundamentally transformed how financial institutions (FIs) understand and measure risk, prompting a shift to a proactive approach to credit risk management. FIs must anticipate and make future losses provisions, rather than reactively responding only after a loss has been incurred. This shift necessitates accurate financial reporting and extensive disclosures, including the recognition and measurement of expected credit losses (ECL).

This means that banks and FIs must embrace a new approach based on automation, integrated data flows and agile models that can keep up with the dynamic nature of the market and customer behaviour – powered by reliable, expectation-based subledger accounting.

The evolving demands on ECL

To comply with IFRS 9 requirements, banks and FIs face the challenge of creating highly complex, data-intensive workflows, where they gather, assess and process vast amounts of information regularly to manage their risk position effectively. These complex workflows are essential for both accurate ECL modelling and meeting the stringent financial reporting and disclosure requirements of IFRS 9.

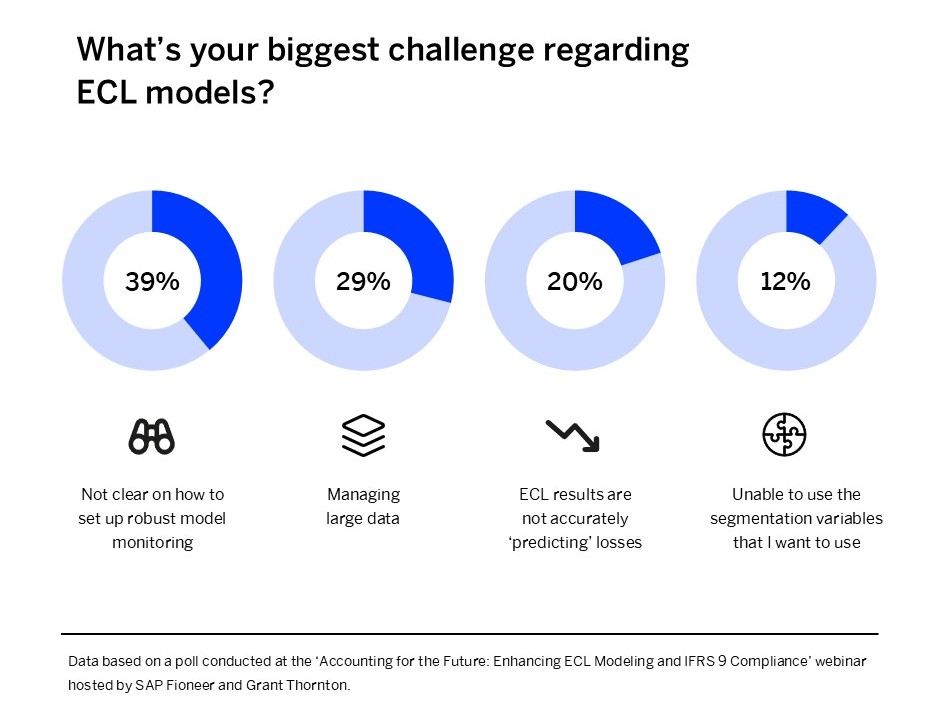

Polling the audience at the recent webinar Accounting for the Future: Enhancing ECL modeling and IFRS 9 compliance hosted by SAP Fioneer and Grant Thornton, it is clear that institutions face a range of challenges. Many struggle with establishing robust model monitoring systems, whilst others face difficulties managing vast datasets and accurately predicting losses.

In their attempt to understand customer behaviour and market conditions in as close to real-time as possible, banks and FIs need more reliable, current information based on real-world activity.

According to Jatin Kalra, Partner at Grant Thornton Bharat, this is information banks may already hold; it’s then a matter of effective integration. This detailed data would enable the modelling of expected customer behavior and risks at a portfolio level, leading to more accurate insights.

Kalra explained that the need today is for ECL models to be sensitive to changes in the portfolio and macro-economic circumstances. The models should allow for tweaks to be made in an efficient manner. For effective model management, it is also important to build in data pre-processing checks, model monitoring and validations tests.

The missing step is a dedicated financial product subledger that can leverage synergies with both the contractual and risk management systems.

Moving beyond traditional accounting processes

During the webinar, SAP Fioneer’s Michael Hafner, Product Manager & Enterprise Architect of Finance Solutions, explained how traditional accounting methods currently deliver an incomplete picture of ECL models. To remedy this, he said, banks must integrate solutions that can leverage expected cash flows to capture insights on market and customer behaviour.

"We think that a subledger-based approach is the best way to bridge the gap between the operational risk management and finance worlds, also due to the huge volume of data and specialized dimensions you have to deal with."

Banks and FIs typically bridge the gap between finance and risk management domains with custom solutions, databases, and spreadsheets, making it hard to ensure data lineage when working at the level of scale and detail that IFRS 9 demands.

A dedicated subledger for financial products can link data flows from source systems to the finance and disclosure outputs, working as a layer between the transactional systems and the general ledger.

Transactional and risk management systems hold the most detailed data, while the general ledger aggregates data on the financial statement level. The subledger bridges these systems together, combining granular data from contracts and risk management for a comprehensive portfolio view.

Hafner explained that this provides structural benefits for the system as a whole: “It unburdens the source systems from accounting tasks, with all activity centralized in the subledger. It also provides reconciliation across the whole accounting flow, enabling drill down to the lowest level and supporting movement analysis.”

The subledger can also provide a wider variety of key dimensions—such as cost and revenue structure, accounting changes, and notions of present values—enabling more granular reporting and disclosures for external and management accounting.

By categorizing cash flows based on type (e.g., principal payments, costs, or revenues) and change drivers (e.g., time, market data, or customer behavior) and applying present value concepts, the subledger generates detailed interim values and delta postings. These allow institutions to derive all of the financial reporting and disclosure information required for IFRS 9.

The race to implement expectation-based accounting

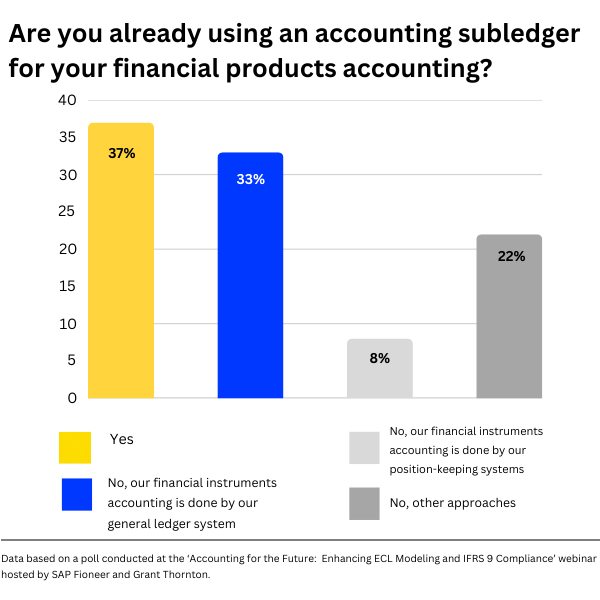

This approach is growing in popularity. Among the webinar audience, over a third of respondents’ organizations use a subledger for financial instruments accounting.

Just under a third indicated that their organization accounts for financial instruments in the general ledger system, while the remaining third utilizes a different approach.

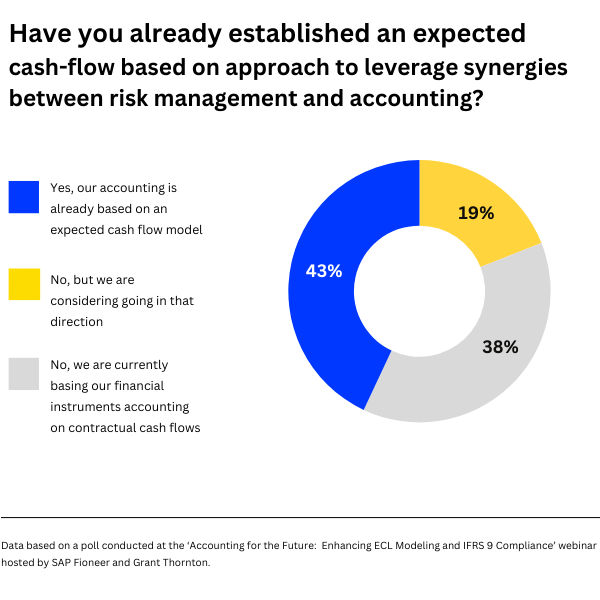

Meanwhile, most institutions are focusing on a forward-looking, cash flow-based approach to maximize the combined power of risk management and accounting. Over 60% of respondents had either implemented an expected cash flow model, or were considering moving in that direction. However, a notable 38% still relied on contractual cash flows, with all the challenges and limitations they brought.

The move towards an expectation-based subledger approach will likely be accelerated by the highly standardized nature of regulation, which creates similar conditions across regions. While additional disclosure and reporting requirements may exist, these can be addressed with a standard solution, especially one with an extensible data model that allows for unique dimensions to accommodate specific requirements, such as SAP Fioneer’s Financial Products Subledger.

Looking ahead to 2025

The fields of ECL modeling and data integration are evolving rapidly. 2025 presents an opportunity to build systems that adapt to changing demands. This includes moving beyond contract-based accounting, strengthening collaboration between risk and finance teams, and leveraging expanding datasets to develop more sophisticated models.

Crucially, by embracing expectation-based subledger accounting, financial institutions can transform regulatory compliance into a strategic advantage, paving the way for smarter, more agile financial operations that keep pace with an increasingly dynamic global landscape.

Advertise

Advertise