Here's why middleware is vital for Asia's financial services sector

By Damien WongBusinesses today face a host of unavoidable challenges that need to be tackled in order to achieve core business objectives, including lowering costs, increasing revenue and enhancing competitive advantage. In the financial services sector, these demands are further exacerbated by the unique challenges facing the industry, not the least of which is the inevitability of race-like conditions and the need to capture, analyze, and act on information as soon as it appears.

Companies within this industry are placing substantial focus on middleware software as an integral part of large-scale IT projects. Middleware itself is a category of software that encompasses a range of discrete components such as application servers for application deployment, enterprise service buses (ESBs) and messaging platforms for integration, business rules management systems (BRMS) with event processing to analyze business events and automate decisions, and business process management (BPM) platforms to automate business processes.

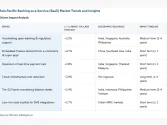

It is thus of little surprise that, according to research conducted by IDC in a 2012 report, the Banking and Financial Services sector took the largest share of spending on BPM- and middleware-related technology in the Asia Pacific region.[1]

But why is middleware so vital in this industry? There are several recurring issues that are extremely pertinent in financial services, such as the complexity of business processes, security concerns, speed and timeliness of information, and customer satisfaction.

As with all businesses, there is tremendous pressure to achieve maximum scalability, performance and effectiveness while simultaneously keeping costs low. Financial institutions are in search of systems and policies that are effective, scalable and represent the best technical practices and capabilities in the marketplace.

In view of these constant challenges, a key strategy that helps businesses achieve these goals is the integration of middleware into existing IT infrastructure.

For example, leading financial services giant NYSE Euronext met its need for a single, common and flexible platform to help simplify the company’s application development, deployment, and management processes by moving to open source middleware. In doing so, the company experienced 50-60 percent cost savings and met mission-critical requirements for reliability, performance, and scalability.

From an IT perspective, these requirements are second to none. Applications deployed and managed by NYSE Euronext must maintain a high degree of integrity and peak performance throughout the trading day. If systems should stall or fail, the world’s financial markets could be significantly impacted.

https://sg.redhat.com/resourcelibrary/case-studies/nyse-euronext-standardizes-on-jboss

Development teams in the financial services industry are generally concerned with how easily applications can be integrated into existing IT infrastructure, in the midst of building and hosting them on platforms. Thankfully, open source middleware provides a platform that is both able to integrate and orchestrate enterprise applications while also automating business processes. This minimizes loss of information and down time, even in the development process.

Dutch mortgage administrator Stater faced the business challenge of upgrading its existing mortgage support services and administrative processes. Having found that simply updating its existing proprietary application platform was insufficient to support Stater’s evolving customer needs, the company opted to migrate to an open source application platform to take advantage of the latest Java developments and to apply release maintenance management on the company’s modeling software.

https://www.redhat.com/resourcelibrary/case-studies/stater-further-increases-stability-with-jboss

The new infrastructure enables Stater to update customer releases without having to shut down applications in progress. The open source middleware also enables the company to perform release maintenance management quickly and efficiently, which was one of the organization’s primary goals for the migration. The open source solution offered Stater the benefits of stability, security, and cost savings.

Security is among the top concerns for financial institutions, given the significant priority placed on it by customers and industry regulators. Thus, a secure IT infrastructure is imperative to handle transactions and protect sensitive information. In response, middleware has been deployed as a robust safety valve to cope with the wild fluctuations Internet use generates.

Likewise, it is used to control access to applications – a key requirement that enables banks to meet regulatory requirements, as well as provide data privacy for customers and minimize the risk of fraud. Once again, middleware allows institutions to become more competitive, while offering sophisticated services to their customers.

Given the unique characteristics of the financial services industry, institutions should recognize the need to incorporate open source middleware into their IT strategies, given its benefits in scalability, security, operations and customer service. Organizations such as NYSE Euronext and Stater recognized this and made the open source choice, and are now well equipped to cope with issues that plague their competitors.

__________________

[1] https://mis-asia.com/tech/industries/idc-forecasts-growth-for-apejs-bpm-and-middleware-market/

Advertise

Advertise