Hong Kong banks' loan growth rose 3% in May

HKD loans were buoyed by mortgage demand.

Hong Kong banks saw a subdued loan growth of 3% YoY in May. It remained flattish compared to the figures in April, according to OCBC Investment Research (OIR).

The research firm attributed the growth in HKD loans to mortgage demand. However, foreign currency loans remained muted and contracted 4% YoY in May.

Also read: Hong Kong banks make do with falling loan growth as earnings lifeline

“We expect mid-single digit loan growth this year owing to a combination of volatilities in USD-CNY movement, uncertainties in business sentiment and liquidity tightness,” the firm said in a report.

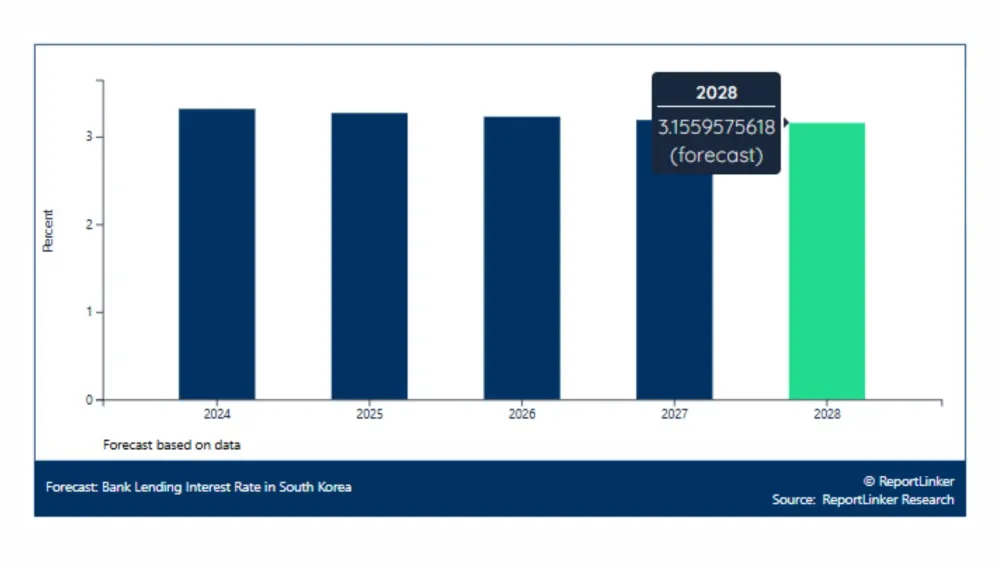

Current forward rates suggest market consensus is expecting around 50-75bps rate cuts in the next 12 months, OCBC Research Team said. “We expect Hong Kong banks’ net interest margin (NIM) to peak in 2H2019 with a slower pace of NIM expansion owing to potential Fed rate cuts, weaker credit demand, and a higher deposit beta as and when banks compete for deposits on the back of tighter liquidity.”

Advertise

Advertise