The end-game for insurers in the scramble for digitalisation

Is a scalable and profitable fully digital insurance firm possible?

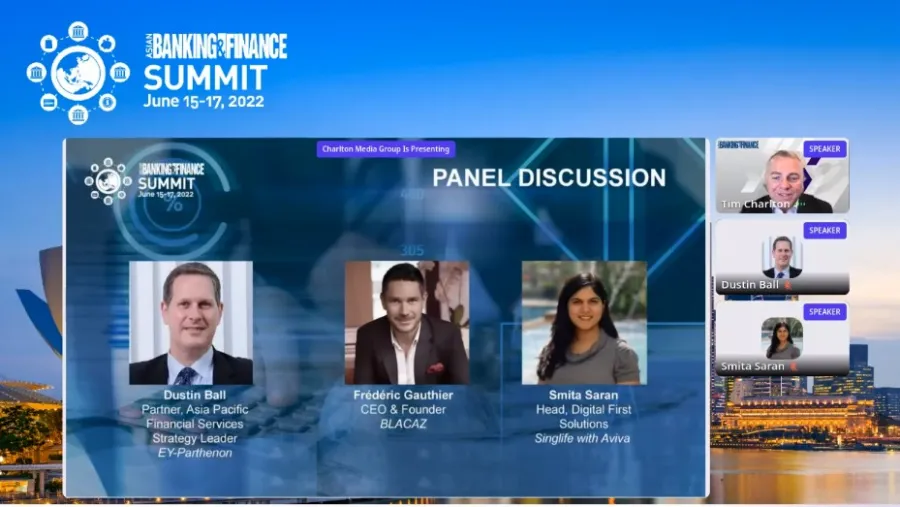

A hunger for digital services ignited the spark for many firms to begin their digitalisation journey and the insurance firm is no exception. With the likes of digital banks popping up in many markets in Asia as an example, a question was then asked in the recently concluded Asian Banking & Finance Summit: is it possible to create a scalable and profitable fully digital insurance company?

Frédéric Gauthier, CEO & founder of insurtech firm BLACAZ answered this with a hard no during the Growing Appetite for Digital Services in Insurance to Spark a Digital-First Insurance Offerings and Insurance Innovations panel discussion moderated by Dustin Ball, Partner and Asia Pacific Financial Services Strategy Leader at EY-Parthenon.

“Fully digital I would have to say no because it’s the insurance industry and servicing is very important. You have to have a mix of digitalisation and [face-to-face] human services,” Frédéric said.

This was seconded by the other panellist in the discussion Smita Saran, Head of Digital First Solutions at Singlife with Aviva.

“Especially if you speak about life insurance. To my knowledge, there isn’t a fully digital life insurance experience,” Smita said.

Simple products only

Both panellists agreed that a fully digital insurance experience isn’t that wholly impossible. It just has to adhere to a strict requirement and that is to sell simple products only.

“As the products become more complex, people seek advisors and I don’t feel that currently or even in the near future we will see a fully digital life insurance company that is able to fulfil a range of demand and a range of products in a digital manner,” Smita said.

Smita said that the first thing you will think about when it comes to life insurance going digital is sales. This means thinking about how you are reaching customers and how you are selling your product. For complicated products or bespoke products, an advisor is always necessary.

However, that doesn’t mean that you can’t sell insurance products without advisors. What insurers need to do is keep products simple enough for consumers to understand.

“[Customers] are simply looking for simplicity. They just want the product to deliver what it is exactly it is expected to deliver and they want to pay an economical price for it. They (customers) are not looking for discovery, they are not looking for advice, and they are not looking for bespoke riders and bundles. They are just looking for what they want,” Smita added.

Examples of these are travel insurance products, motor insurance, home insurance or even family bundle insurance products and gadget insurance.

For Frédéric, technology is used mainly to support the user experience. He said that nothing can replace the human relationship when it comes to insurance, especially with the first insurance purchase.

New disrupters?

Before the end of the discussion, the panellists were asked what they think is something new in the industry that would be new disrupters for insurers.

Frédéric believes that the rise of cryptos and NFTs will be new terrain for insurers.

“You have this new marketplace which is completely outside of the traditional insurance space. In fact, we got a lot of requests for NFT insurance. This is something that has become more and more in demand and I foresee this [increasing] in the next two years,” Frédéric said.

Smita, meanwhile, believes that insurers will be focused on creating more financial services offering for customers.

“Everybody (financial services industry) has been trying to stitch together payments, wealth, and insurance solutions that try to solve everything that the customer needs in one place. I don’t think it has been done yet successfully. I feel that it’s a really interesting space and I want to see [someone will get to that finish line],” Smita said.

Watch the video below to watch the panel discussion:

Advertise

Advertise