APAC DM banks take on more risk as margins shrink

Aussie banks are growing their SME exposure whilst other banks are expanding overseas.

Asia Pacific's developed market (DM) bank may take on additional risk in loans as net interest margins (NIM) slow and amidst profit pressures due to trade tensions.

Riskier appetites can already be observed in Australia, where banks have emphasized growth in the small and medium-sized enterprise sectors in recent years, said Fitch Ratings in its 2026 outlook report for APAC DM banking sectors.

For other markets such as Japan, South Korea, Singapore, and Taiwan, this has occurred through expansion into higher-margin overseas markets, Fitch said.

Fitch expects the greater risk appetite to remain incremental in nature.

"A more rapid pace of expansion into riskier sectors and markets may have a short-term positive impact on earnings but would increase the risk of weighing on asset quality and credit costs over the longer term, with the potential to offset the benefit to earnings from higher NIMs," Fitch wrote in the report.

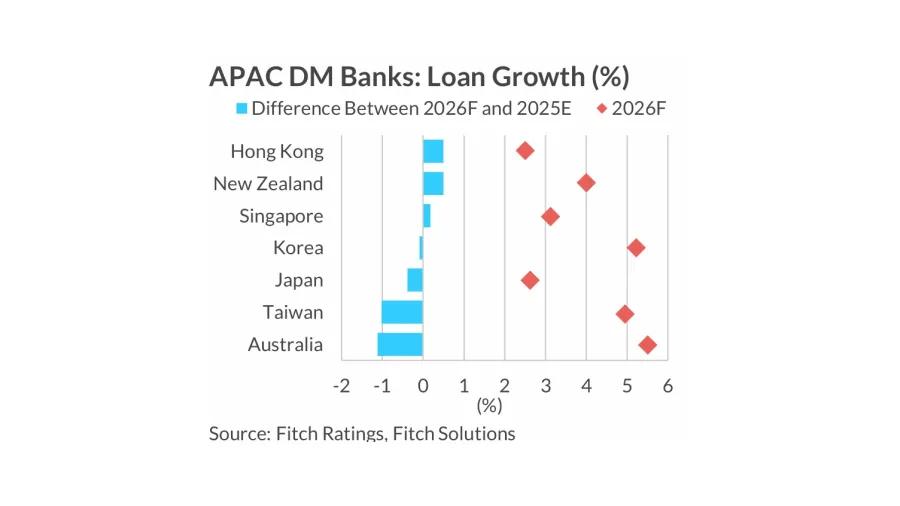

APAC's DM banks are expected to see lower margins in 2026 as interest rates ease. Except for Japan, the six markets under this category— Taiwan, New Zealand, Australia, South Korea, Singapore, and Hong Kong— will see lower margins compared to 2025, according to Fitch.

Amongst the markets, Taiwan and Hong Kong hold a deteriorating outlook.

Hong Kong's banks will continue to grapple with real estate stress next year, although wealth management is a bright spot.

Taiwanese banks, meanwhile, are expected to maintain solid capitalization through 2027 on prudent capital policies, S&P Global Ratings said in a report published earlier in 2025.

But their loan growth will likely moderate through 2026 amidst heightened uncertainties from tariff uncertainties

Advertise

Advertise