Emerging Asia leads as top investment destination of Western FIs

Four of the priority markets are in ASEAN: Malaysia, Singapore, the Philippines, and Indonesia.

Countries from “emerging and developing Asia” are drawing investors in more “developed” nations, particularly western financial institutions (FIs), based on a survey by Standard Chartered of 400 European and American headquartered FIs.

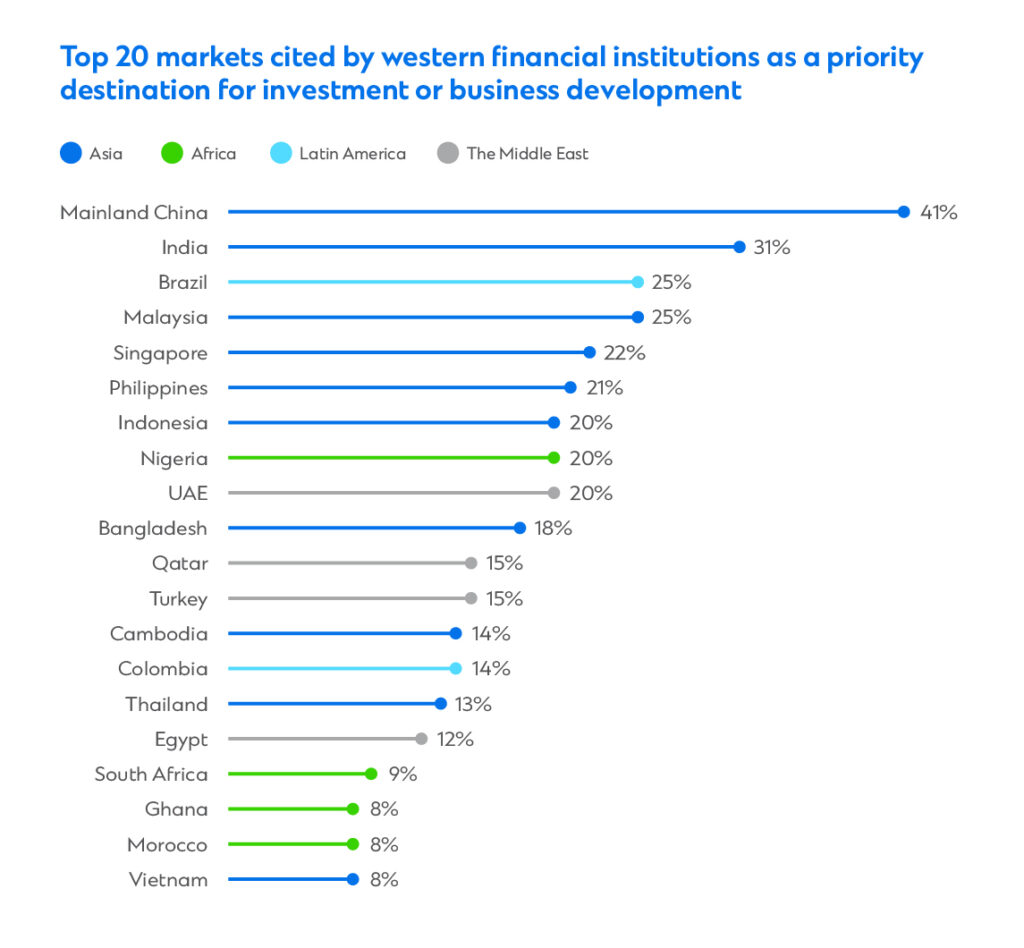

Of the top 10 markets which FIs have described as priority destinations for investment or business development, 7 of them are from Asia, with Mainland China and India being the top markets.

Four of these markets are ASEAN member states: Malaysia (4th), Singapore (5th), the Philippines (6th), and Indonesia (7th).

Other Asian countries include Bangladesh (10th), Cambodia (13th), Thailand (15th), and Vietnam (20th).

Nations described as “emerging and developing Asia” are predicted to experience real annual GDP growth averaging between 4.5% and 5.2%, according to estimates by the International Monetary Fund (IMF).

In contrast, GDP growth of “advanced economies” are expected to fall at just 1.7% to 1.8%.

“Over the medium-term, India, the Philippines, Vietnam and Bangladesh are likely to maintain consistently higher growth rates [GDP], and growth in Malaysia and Indonesia should also be solid,” says Molly Duffy, global co-head, Financial Institutions Coverage at Standard Chartered.

“The African growth story is equally distinctive: success stories such as Senegal and Cote d’Ivoire are a result of positive domestic reform and opening to global trade. We also see a lot of upside potential in Egypt,” she added.

The so-called China Plus One phenomenon – the idea that western companies and investors should avoid overdependence on Mainland China by increasing their exposure to other economies – is one reason why there is growing demand for a wide range of dynamic markets, according to Standard Chartered.

Mainland China’s size and economic clout means it will inevitably continue to attract investment, it added.

“Banks are clearly at the forefront of supporting capital entering dynamic markets,” Duffy said, adding that Standard Chartered expects that “sizable” investments in high-conviction asset classes in these economies to continue.

Advertise

Advertise