Indian banks make headway in denting bad debt in Q3

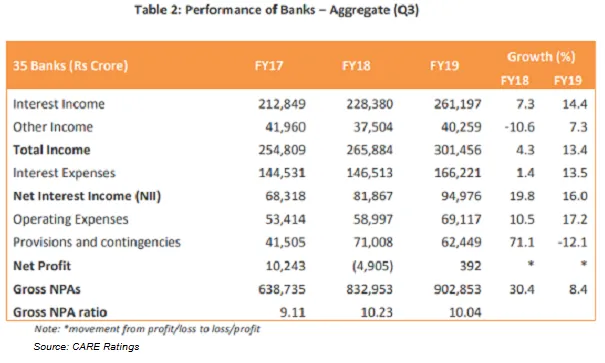

The growth of gross NPAs fell to 8.4% from 30.4% the previous year.

Banks in India made progress in resolving their massive bad loan problem as the growth of non-performing assets (NPAs) slowed to 8.4% in Q3FY19 from 30.4% the previous year, according to CARE Ratings.

“The NPA situation in the Indian banking system has been stabilising as can be seen in Q3 FY19,” the firm said in a report. “Another quarter of moderation in growth of NPAs could indicate that the recognition cycle is over.”

Overall, the NPA ratio of the Indian banking sector edged down to 10.04% in Q3FY19 from 10.23% although it cautioned that it remains to be seen whether banks have recognised all legacy NPAs.

Also read: Will Indian banks sink under the weight of the country's worst water crisis?

Public sector banks (PSB) continue to hold more than thrice the amount of soured assets than their private counterparts in Q3 as the former’s NPA ratio hit 13.09% compared to the latter’s 4.16%.

As banks tuck the worst of their bad loan woes away, credit has started picking up in Q3 to the benefit of the economy with personal loans registering double-digit growth. Interest income also grew 14.4% from 7.3% amidst higher weighted average lending rates.

Bank earnings, however, remained under pressure with PSBs seeing earnings of RS392 crore during the quarter whilst private banks saw profit growth slow to 3% in Q3FY19 from 12%.

Advertise

Advertise