APAC

Superapps to help drive BNPL userbase to 670 million by 2028

Superapps to help drive BNPL userbase to 670 million by 2028

Superapps like WeChat and Grab are adopting and offering BNPL services to users.

APAC payments gateway market to rise 30% as cashless economy expands

The market is expected to grow by over 11% between 2023-2027.

Citi revenue up 49% to $1.7b in 2023 as corporate lending grew

Both equity and debt underwriting fees rose.

Banks grapple through era of disruption by being the disruptor

Companies are facing not just tech transformations but also shorter skill lifespans for their workforce.

Beyond the Hype: Building Trust in Generative AI for a Secure Financial Future

Financial organisations lean on AI to unravel complex issues, a shift propelled by an exponential rise in big and alternative data sources.

Citi is Asia’s top equity capital markets underwriter in Q1

The bank reportedly commanded a total issuance volume double to its closest rival.

HSBC sells Argentina banking operations with $1b loss

Grupo Financiero Galicia will be paying $550m for the unit.

60% of commercial banks don’t have women in C-suite roles

No woman was appointed CEO of a commercial bank over the past year.

Visa tokens bring $15b to Asia Pacific digital commerce in 2023

The company said Visa token issued has so far reached 1 billion.

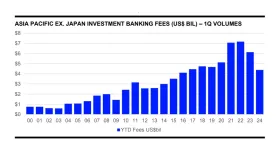

APAC ex Japan investment banking fees in Q1 falls to lowest level in 8 years

Equity capital market fees were halved, whilst debt capital market fees were static.

StanChart’s SC Ventures and NEXT176 unveil Shariah-compliant wealth platform

It will merge SC Ventures’ Autumn with NEXT176’s 22seven into one new platform.

Brunei, Laos central banks formally join Regional Payment Connectivity Initiative

There are now a total of eight ASEAN central banks in the regional payment link.

Embedded finance market to double in four years

The industry’s growth is seen to continue at least in the next four years, mainly due to the B2B market.

The Transformative Power of Finance for the People

At the end of the day, financial inclusion should not be a privilege, but a fundamental right.

Empathy deficit erodes customers’ trust in banks

Customers who feel valued are willing to spend more for banking products.

SMBC reels new managing executive officer and co-head for Asia Pacific

Katsufumi Uchida succeeds Yuichi Nishimura in this role.

APAC banks ready for Basel III

Transition is not expected to have a substantial impact on capital requirements.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership