APAC

JCB contactless payments now available in the UK

JCB contactless payments now available in the UK

In 2024, JCB plans to enable contactless payments in the remaining 80% of UK Worldpay terminals.

Corporate bonds, liquid assets key to investment wins in 2024: Standard Chartered

The expected US recession next year will significantly impact how bonds perform.

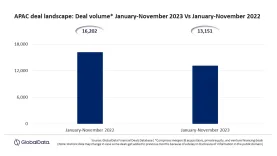

APAC M&A down 18.8% 11M’23

The region saw a total of 13,151 deals in the eleven months to November.

JCB pilots central bank digital currency payment solution

The pilot aims to enable transfer of CBDC offline, and without the need to change POS terminals.

How banks can ensure customer safety in Gen AI adoption

Gen AI is expected to add up to US$340b in new value to banks. But obtaining a slice of this will not be an easy process.

Alipay+ daily transactions up 70% in H2

Partner wallets saw daily transaction volumes increased three-fold.

Alipay+ launches year-end sustainable travel campaign in Asia

Travelers will be rewarded for bringing their own toothbrushes, amongst others.

Asian Banking & Finance Forum 2024 returns to Bangkok on April 17

The forum will also be held in Ho Chi Minh, Jakarta, Kuala Lumpur, and Manila.

Unlocking the potential of sustainable lending in Asia

Aligning lending practices with rising sustainability expectations is gaining traction in Asia, but accelerating the green transition will require open and collaborative data ecosystems.

APAC emerging banks’ profits to benefit from higher rates in 2024

Expect some minor asset-quality deterioration, however.

Saxo CEO stresses digital wealth’s key role in investment access

The wealthtech industry is expected to skyrocket its ‘onshore’ PFA of around $81t (SG$108.27t/HK$632.82t) by 2027, driven by Singapore and Hong Kong markets.

Arthur D. Little sees embedded finance growth to $350b in 2024

Generative AI and the expansion of fintech brands into the insurance sector are predicted to propel the industry’s advancement to new heights.

Gen AI to add up to $340b new value to banks: McKinsey

It will add $56b and $54b in new value to corporate and retail banking, respectively.

SMBC hires ex-Nomura banker as head of APAC private credit distribution

Yew Chuan Sim will lead the bank’s distribution efforts in APAC.

Weekly Global News Wrap: US regulator warns of BNPL risks; Citi overhaul to cost $1b, done by Q1

And Moody’s put Hong Kong and Macau banks on downgrade warnings.

Banks face negative outlook in 2024 amidst bad loans, higher costs

ASEAN banks, however, will benefit from policy changes arising from geopolitical tensions.

Hong Kong, Thailand launch cross-border QR payment service

HSBC and Bangkok Bank serve as settlement banks.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership