APAC

APAC developing markets slated to see lower margins in 2026

APAC developing markets slated to see lower margins in 2026

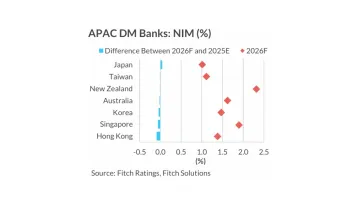

Except for Japanese banks, which could see NIMs rise faster if monetary tightening is more aggressive than expected.

Be recognised amongst Asia's leading banks at Asian Banking & Finance Awards 2026

Showcase your excellence and innovation in retail, wholesale, and corporate and investment banking.

Celebrate your financial technology excellence at Asian Banking & Finance Fintech Awards 2026

Put your innovations into the spotlight and gain recognition for your success.

China, Taiwan, Hong Kong, Thailand banks face weaker 2026 outlook

Japan is the only banking market in APAC to hold an "improving outlook," according to Fitch Ratings.

Banks a key entry point for Web3 adoption

Over 8 in 10 will use or will strongly consider using Web3 services if offered by a bank.

UnionPay expands Apple Services payments to 15 markets

Cardholders can use their cards to pay for Apple’s digital content.

Fubon Bank to sustain retail deposit growth and buffers

The bank’s loan-to-deposit ratio has improved and is below the industry average.

Banks’ outlooks steady despite geopolitical risks and possible tariff shocks

These lenders have “satisfactorily contended” with stressful conditions over the past five years.

Mizuho Bank speeds up ISO compliance, eases payment with Boomi

With the online portal, firms can input payment instructions using both legacy and ISO 20022 formats.

Payment leaders push for interoperability to solve SME cash flow

Bridging the gap requires a regulatory framework to achieve finality in payments.

TNG eWallet, easypasia enhance customer service with Alipay+ genAI platform

They will offer tailored product recommendations and timely reminders.

Tokenisation, cyber threats top agenda at Singapore FinTech Festival Day 2

MAS unveils pilot for tokenised MAS Bills as leaders warn of rising AI-enabled cyber risks.

Maybank inks cross-border payments MOU with XTransfer

Collaboration expands FX and Islamic payment reach across ASEAN markets

MAS issues draft AI risk guidelines for all financial institutions

Guidelines cover governance, lifecycle controls and proportional AI safeguards

MAS completes live trial of interbank lending using wholesale CBDC

SGD Testnet enables financial institutions to settle tokenised financial assets using wholesale CBDC.

Visa expands Intelligent Commerce framework across Asia Pacific

The trusted Agent Protocol enhances verification for AI-led transactions.

Visa expands scan to pay QR network across APAC

Unified wallet integration under Visa Pay enhances regional acceptance

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership