China

Chart of the Week: Chinese banks' loan growth slows to 13% in August

Chart of the Week: Chinese banks' loan growth slows to 13% in August

New loans have reached about $2.1b for the first eight months of 2020.

Chinese banking sector's net profits down 24.6% YoY in Q2

Improvement in sight for H2, but lenders may face capital shortfall.

More profit woes for Chinese banks as regulators plan NPL hike

$160.9m of targeted full-year NPL resolution were completed in H1.

Citibank granted domestic fund custody licence in China

The bank can now provide custody services to Chinese mutual and private funds.

Chinese banks with more shrewd NPLs see slim earnings hike

But banks are still likely to slash dividends.

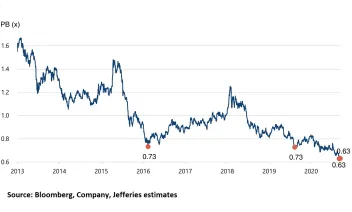

Huge capital gap hounds China's big banks

The gap could expand up to $943b by 2024.

Chinese banks' liquidity still enough despite key metrics slumping

Asset quality grew 10.8% in Q2 from 9.4% a year earlier.

China's megabanks ramp up employment despite falling profits

The Agricultural Bank of China has already hired 4,500 people.

Chinese banks face first H1 profit drop in a decade

The regulator has urged banks to recognise bad loans and hike buffers.

China's new loan prime rate to further hurt banks' profitability

The decline in average loan yields will deepen as more loans are repriced.

PBOC injects cash into banks to ease stress

It added $101b (CNY700b) of one-year funding via the medium-term lending facility.

China's P2P online lenders owe over $115b to investors

They have also dropped to just 29 across the country.

Relief extension for Chinese shadow banks beneficial but limited: Fitch

It will not offset the impact of investor risk aversion.

Return of private placements boost Chinese regional banks' capital

They allow for tailored government participation in bank recapitalisation.

HSBC to hire up to 3,000 wealth planners in China

The first 100 people have already started in Guangzhou and Shanghai.

Chinese banks should shift from SWIFT as sanctions loom: report

Higher usage of the country's own payments network would cut its exposure to the US.

Harnessing the power of AI to accelerate financial inclusion

There is a popular analogy comparing artificial intelligence (AI) to electricity. Just like the role of electricity during the second industrial revolution, AI has the same potential to greatly transform how industries function and benefit humankind. However, this analogy in my opinion is over-simplified. The power of AI is much harder to standardize and harness, and it requires a far more collaborative effort to bridge existing gaps between academic research and solving real-world problems.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership