China

China’s top brokers downgrade senior bankers’ travel perks to cut costs: report

China’s top brokers downgrade senior bankers’ travel perks to cut costs: report

Managing directors are asked to fly coach for domestic travel.

Citi Global Wealth APAC Co-head Fabio Fontainha outlines bank's ambitions

Fontainha expounds on Citi's wealth goals, which include adding $150b AUM across the APAC franchise in four years’ time.

Citi Private Bank names southern, western Mainland China global market manager

Seamus Yin will be responsible for leading coverage of clients in central, western, and southern China.

Nomura Holdings loses 20 investment bankers in Asia: report

The resignations include their head of Greater China equity capital markets.

Local bond market’s problems heighten Chinese banks' credit risks

The bond market’s repayment woes may force banks to make concessions for the sake of financial stability.

Chinese banks warned against rising bad debt as measures subside

CBIRC also warned against emerging local real estate bubbles.

China orders banks, insurers to draft 'living wills': report

This is to ensure that troubled financial institutions won't end up needing costly bailouts.

HSBC plans to split leadership of Asia with two co-heads: report

Wong protege David Liao and India’s Surendra Rosha are rumored to become co-heads.

China’s Huarong likely to receive extraordinary government support: S&P

This also bodes well for its overseas bond issuer Huarong International.

Deutsche Bank appoints new head of trade finance & lending in China

Daniel Qian is also head of structured trade & export finance.

China’s $1.3t domestic debt hurtles to maturity as defaults surge: report

The huge debt, unprecedented pace of defaults underscores local authorities’ conflicting goals.

Global banks on a hiring craze as they vie for rich Asians’ assets

HSBC, Goldman Sachs, and Citi are all eyeing a piece of the region's trillion-dollar financial market.

VCs flocking to "lucrative" APAC payments segment: report

Global VC deals rose to 620 in Q1 2021.

China injects $15.5b cash into the financial system to maintain liquidity: report

The nation’s top leaders recently described economic recovery as “unbalanced and unstable.”

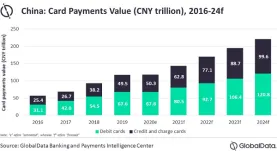

Chart of the Week: Card payments in China to rebound 21.3% in 2021

Card payments are set to rise as economic activities gathers pace.

Goldman Sachs ramps up China ambitions with hiring spree: report

It is planning to add over 400 new people in its headcount in 2021 alone.

HSG shares insights on modelling core banking IT for the digital economy

Sisi Yu gives us a glimpse of how banks can achieve higher performance through improved services.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership