China

Asian equities lost up to $3.5t in investor wealth due to pandemic

Asian equities lost up to $3.5t in investor wealth due to pandemic

Safeguarding wealth and low-risk assets will be investors’ focus.

Chinese regulator's MSE loans buy won't help regional banks' capital

But ChongQing Rural Commercial Bank and Bank of ChongQing will slightly benefit.

China shuns ‘clean coal' in new green financing guidelines

Billions of yuan have been used in green financing of coal-related projects.

Chinese banks' volatile results posit hazy future for 2020

City commercial lenders’ profits followed a “V” curve from 2017-2019.

Chinese central bank should dodge bond buying: adviser

It could lead to inflation and the depreciation of the yuan.

China's central bank to run medium-term loan operations

A batch of $28.b in loans will expire on 14 May.

Chinese banks still see long-term stability ahead

The sector is cushioned enough to absorb eroding asset quality.

2020 tipped to be the worst year for China's retail savings and investments

Losses will affect China’s high net worth segment significantly.

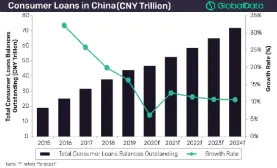

Chart of the Week: China's consumer lending market growth to stall at 6.2% in 2020

This is ten percentage points lower than the 16.3% growth recorded last year.

COVID disruptions intensify risks for Chinese banks

Regional banks are more vulnerable due to weak capitalisation.

Coronavirus drags on Chinese leasing firms' profits

Those with no parent banks to bail them out will be the most severely impacted.

Chinese banks post net profit, operating income growth in 2019: report

Sample size was equivalent to 71.37% of total assets and 76.77% of net profit.

Coronavirus to amplify hierarchy in Chinese banks: analysis

Banks with high exposure to SMEs will bear the brunt of the epidemic.

Chinese banks post loan recovery in March, but further growth unlikely

A fiscal stimulus is needed to spur demand.

China shadow banking credit down $42b amidst pandemic disruption

A 5% dip in core shadow credit triggered the fall.

ICBC resilient against pandemic drawbacks: analysis

But it may have a hard time sustaining its 2019 net profit growth.

Chinese central bank's RRR cut raises banks' asset yields: analysts

Higher asset yields will relieve pressure on profitability.

Advertise

Advertise

Commentary

Fighting fraud in the digital banking age

Asian banking’s next frontier: Beyond growth, embracing precision

Rethinking cybersecurity: How APAC banks can safeguard against AI-powered threats

Why Singapore’s fast payments need faster protections