Korea's open banking system threatens dominance of credit card issuers

Credit card issuers may lose their tax incentive to fintechs.

The plan by the Korea Financial Services Commission to open access to the bank settlement system will weigh on the bottomline of credit card issuers that have a stranglehold in the country's consumer needs, according to Moody's Investors Service.

Also read: Tech firms set to raise stake in Korea's internet-only banks

The regulator is setting up an open banking system with mandatory participation from banks and a unified commission rate which will allow fintechs to develop payment services based on a bank's settlement system through open API.

Opening up banking system would mean that third-party players can develop services at a lower cost and utilise payments through bank account transfers with local media reports estimating that the network’s usage fees will be lowered by a tenth from the current rate of $0.35-0.45 (KRW400-500).

"The plan is credit positive for banks, but credit negative for credit card companies such as Shinhan Card Co., Ltd. and Woori Card Co., Ltd. because increased competition from alternative payment services will weigh on card issuers' profitability," Tae Jong Ok, Moody's analyst said in a note.

Currently, credit card issuers in Korea enjoy a tax deductible of up to $2,600 (KRW3m) for credit card spendin, an incentive that could easily be in jeopardy as the regulator mulls the feasilibility of a tax incentive for fintech innovation. "If the tax benefit is abolished, extended or transferred to fintech services, credit card companies’ market share will erode and their profitability will decline," explained Tae.

"Furthermore, the plan was announced as credit card companies are starting to wind down consumer benefits in response to the regulators’ plan to cut credit card merchant fee rates announced in November 2018," he added.

Credit card companies are a leading player in consumer expenditure in Korea, with credit and debit cards estimated to account for around 80% of the country's $900b (KRW1quadrillion) commercial payment market.

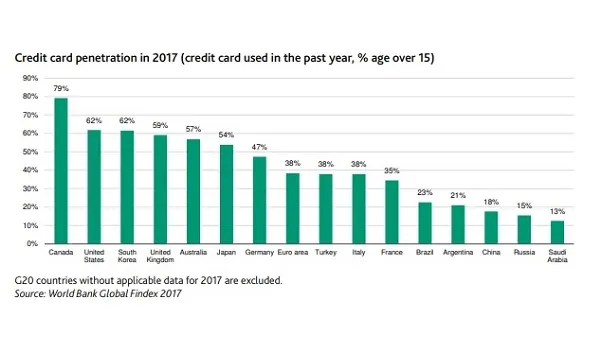

Korea’s credit card penetration, measured as the percentage of the population aged over 15 that used a credit card in the past year, is also one of the highest amongst G20 members at third place where it trails only behind Canada and United States.

Advertise

Advertise