Singapore

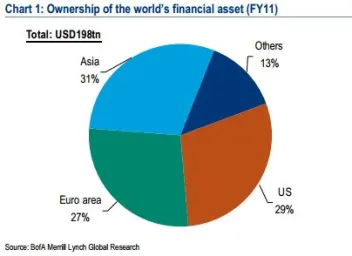

This graph shows how Asia amazingly has majority ownership of the world's financial assets

This graph shows how Asia amazingly has majority ownership of the world's financial assets

Asia accounts for 31% of global banking assets in 2011 from 15% in 2000.

Asian bankers reveal the secret to mitigate short-term profitability pressures

Check out what CIMB, DBS, and RCBC do to keep raking in money.

GRGBanking links with Myanmar's Co-operative Bank for international payments

MasterCard, Maestro and Cirrus cards are accepted.

A call to review Asian banking industry strategies

The global financial and economic meltdown has created a new world with its own array of threats, opportunities and sustainability factors which call for fresh thinking to capitalize new horizons, damage control and preempt fallouts.

You won't believe how StanChart, DBS, RCBC, and CIMB use social media differently

Find out why Standard Chartered is compelled to review how its various internal teams work together.

This is how banks can win Asia's wealth management race worth US$10.7t

Bankers reveal the distinction of Asia's rich from their western peers plus different strategies to better serve Asia growing market of HNWI.

Adapting to changes in business demands while improving growth and operations

Infor understands that competition among enterprises is more than just tough, thus it steps in to provide innovative systems and flexible solutions to give companies the leverage they need.

MIT brings CREDOC and TRAC to Asia

Check out MIT’s premier products for Asia’s trade commodity finance industry.

Maximizing benefits of card networks

MasterCard reveals pieces of advice for companies on getting the pros and hedging the cons on key banking trends.

Standard Chartered appoints Alan Naughton as global product head for investors & intermediaries

And Andrew Hempshall is global head of solution delivery & service, investors & intermediaries.

Standard Chartered appoints Steven Sun as head for North Asia FI strategic coverage

He will report to James Pearson and Darcy Lai.

Meet JP Morgan's new senior hires for its regional sales team

Lillian Sim has been named Regional MNC Sales Head for Asia Pacific.

StanChart Singapore, MasterCard launch first ever interactive payment card

The card has touch-sensitive buttons!

Digital channels still can't beat bank branches as profit centers

Find out what DBS, RCBC, and CIMB have to say on how the role of the branch has evolved as customers migrate to electronic banking.

Singapore banks on track to post 6-8% earnings growth in FY12

DBS is Nomura's top pick.

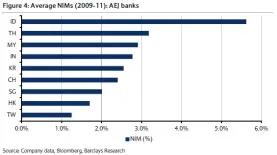

A closer look at AEJ banks' NIMs from 2009-2011

Singapore banks had the biggest margin decline.

Why changing the mindset is as vital for banks as knowing the customer

It’s fair to say that, at the moment, consumer protection high on the agenda of many national regulators and central banks. The global financial crisis has severely dented consumer trust, with the most recent scandal – the LIBOR rate manipulation – dealing a further blow to consumer confidence.

Advertise

Advertise

Commentary

Young Malaysians, big money mistakes: What’s going wrong with Islamic financial behaviour?