Exploring Asia’s banking dilemma on spending vs austerity

By Martin SmithWhen Asian banks look to their European and US counterparts they see the polar opposite of their own post-GFC lending and banking reform initiatives. Euro wide German led austerity measures contrast starkly with Japanese stimulatory ‘Abenomics’, US quantitative easing and other inflation boosting banking reforms in the region. Economic growth and business confidence, generally gauged by lending market activity, is slowly beginning to build stronger impetus. Overall lending growth is still sluggish in relative terms, with a number of Asian countries such as Indonesia, Malaysia and Thailand still struggling to rise up off the canvas following knock out blows by the Asian Financial Crisis of the late 90’s. However South Korea and the Philippines were also adversely affected by the same crisis but have managed to achieve strong lending growth of late - why is this so?

Can spending cuts and debt markets be managed or combined with growth strategies to avoid tarring well capitalised banks with the same brush, as is currently the case in Europe? And will debt-led growth solve one problem only to engender another? The Secretary-General of the OECD, Angel Gurria, broadly supports austerity but believes the two approaches can operate in tandem - “You need fiscal consolidation in many countries and at the same time you need to plant the seeds of future growth. Let’s go for the reforms, accelerate the reforms, so we can consolidate the recovery.”

Austerity measures involving reduced expenditure to target budget surpluses and inflation at a governmental level are frequently reciprocated on a micro level by some banks in Asia reluctant to increase the amount of leverage they are willing to provide to customers. Fearing higher impairment charges and bad debts stemming from more flexible short term debt and liquidity provisions, the banks look to other revenue generating areas such as deposits. This approach is difficult to maintain from a profitability perspective in the longer term given record low interest rates and tough competition for deposits among local Asian and International banks.

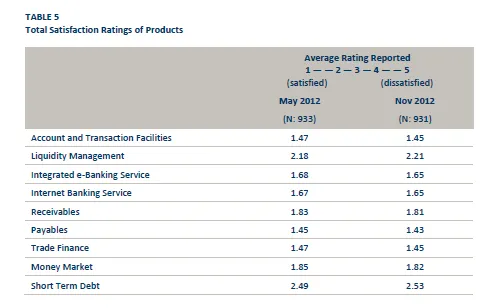

The policy approach of austerity is defined as ‘a state of reduced spending’ – at what point do governments, or banks at a micro level, revert back to a normal state of sustainable lending activity and investment growth? The reluctance to provide adequate lending facilities at a high standard is clearly evident among banking customers in Asia, who according to East & Partners latest Asian Institutional Transaction Banking Report are increasingly dissatisfied with short term debt provision and liquidity management ahead of any other products: (See Figure 1)

This is not to say that all Asian banks are neglecting investment growth opportunities and that all countries in Asia are not increasing lending and investment growth. According to the Reserve Bank of Australia a number of Asian banks have moved aggressively into the syndicated loans market of Australia, increasing their local share of syndicated loans from 13 percent in 2007 to 23 percent in 2012. Bloomberg also cites booming acquisition lending in Asia which has accelerated over three times in the last year, from $3.8 billion in Q1 2012 to $11.4 billion in Q1 2013, excluding Japan. China is driving foreign asset purchasing, providing the lion share of investment growth throughout Asia and abroad, but also potentially crowding out investment opportunities for smaller Asian countries requiring a kick start. The Philippines have achieved strong lending growth in response to low interest rates and readily available liquidity that incentivise personal and business loans.

A counter argument to unbridled credit growth has been suggested by Standard & Poor’s, who have expressed concern over the pace of growth in certain countries such as the Philippines. They propose that excessive credit can eventually lead to greater problems through eager over-investment in certain business segments. Securing productivity improvements should be the fundamental driver. Credit demand is ideal for sparking growth, while ongoing credit dependant growth can quickly become overwhelming.

Gearing levels reached pre-GFC may never be feasible again, however the current state of affairs is fundamentally flawed and counter intuitive if installed over an extended period of time. This policy dilemma for governments, and strategy challenge for banks, will define the Asian banking sector in the years ahead.

Advertise

Advertise