Hong Kong banks ramped up hiring but investment bankers laid off

Trade and private bankers are most in demand, although banks are cautious.

The recovery of staff numbers in HSBC and other banks in Hong Kong propelled the number of total bankers employed in the city to an increase in 2023– but investment bankers are likely not enjoying the hiring boom.

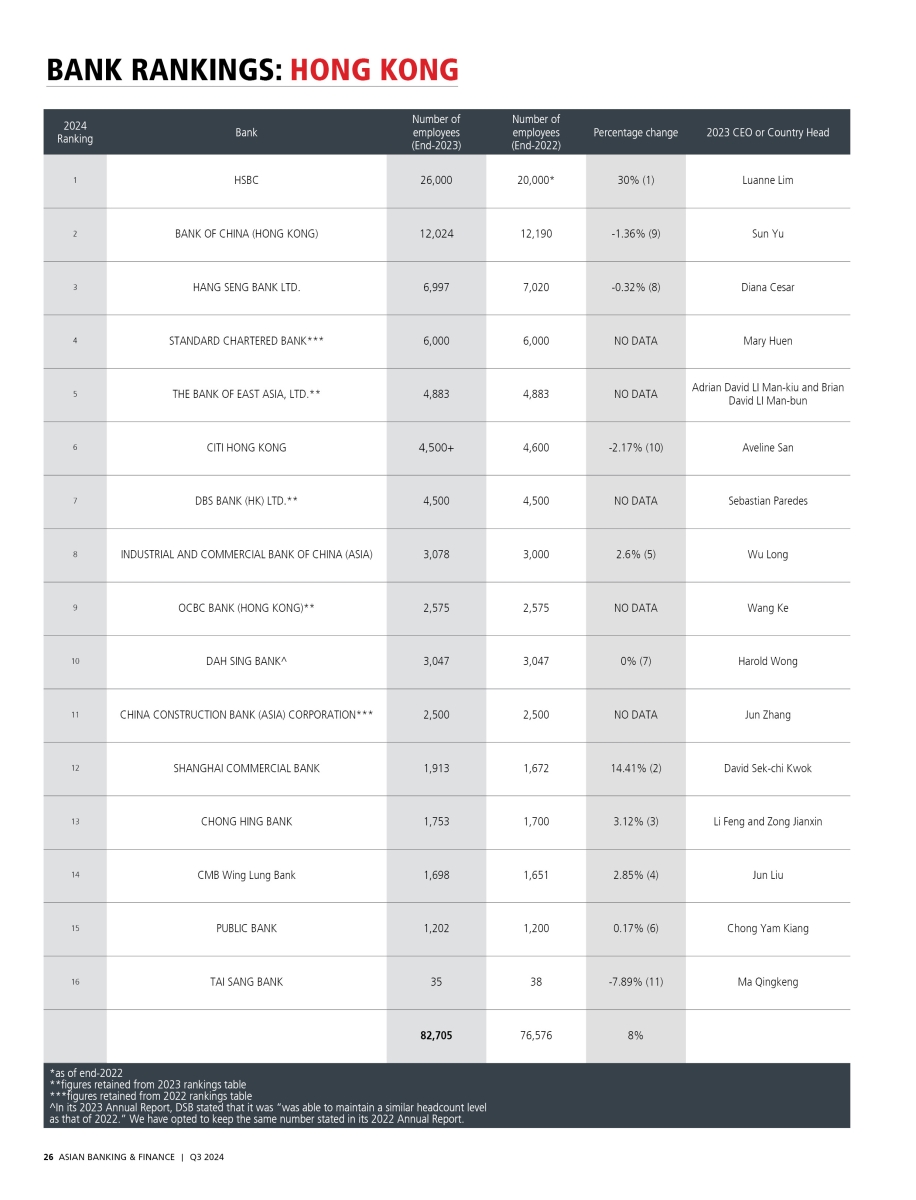

About 82,705 bankers and staff are employed by 16 banks in Hong Kong, according to data from the 2024 edition of the Hong Kong Bank Rankings by Asian Banking & Finance. This is 8% higher than the estimated 76,576 staff employed by the same 16 banks in 2023.

Key to this rise is HSBC, reporting about 26,000 employees in Hong Kong by the end of 2023– a 30% increase from its total staff numbers of just around 20,000 in the 2022 rankings. At its peak, and before it announced a restructuring and planned job cuts in early-2020, HSBC had employed 29,000 staff in the city.

Shanghai Commercial Bank employed a net 241 people over the 12-month period, The bank now has 1,913 employees in Hong Kong by the end of 2023– a 14.41% increase from the 1,672 people it employed in 2022.

Chong Hing Bank, CMB Wing Lung Bank, Public Bank, and the Industrial and Commercial Bank of China (Asia) also saw a net increase in their Hong Kong staff numbers in 2023.

Dah Sing Bank maintained the same level of employees between the two years, the bank stated in its annual report.

In contrast, many of the biggest employers in the city reported lower staff. Notably, Bank of China (Hong Kong) (BOCHK), Hang Seng Bank, and Citi Hong Kong– reported marginal declines in their total workforce between 2023 and 2024.

BOCHK lost over a hundred staff in the 12-month period. Overall, BOCHK’s staff numbers remained at over 12,000 in 2023, hovering at the same levels as the previous year.

Hang Seng Bank reported a net loss of around 23 people over the same period.

Tai Sang Bank, with 35 employees by the end of 2023, said goodbye at least three times over the 12-month period.

Investment bankers laid off

Banks in Hong Kong have ramped up layoffs of investment bankers in the city as they contend with a double whammy of slowing initial public offerings (IPOs) and mergers & acquisitions (M&A), analysts told Asian Banking & Finance.

“Various bulge bracket banks have indeed let go of candidates from analyst to [managing director] level, given the lack of IPOs in the Hong Kong market and M&A activity in Hong Kong and China,” Sue Wei, managing director of Hays Greater China, said in an interview.

Chris Corcoran, associate director of Financial Services for Robert Walters, echoed the sentiment.

“The sell side is very quiet,” Corcoran said, when asked about the current hiring situation for investment bankers in the city. “There are much more layoffs than there are hiring. To be frank, it’s pretty much across the board. A lot of the traditional volume is down on the IBD side.”

Wei, meanwhile, cited the merger of UBS and Credit Suisse, as well as the “global financial situation” as factors for the slowdown in investment banking activity.

Investment banking activity in Hong Kong remained sluggish throughout 2023. There were only 70 IPOs recorded, 21% lower than in 2022; whilst deal value fell by 56% to just HK$46.3b (US$5.93b), according to a report by KPMG.

In Q4 2023, Hong Kong reported the lowest number of active Hong Kong IPO applications, at just 59, compared to 89 applications in Q4 2022.

High salaries a factor?

Wei observed that many international banks are implementing layoffs and redundancy measures primarily at higher salary levels, whilst simultaneously hiring more junior or worker-level staff.

Pre-pandemic, investment bank analysts in Hong Kong reportedly took home HK$675,000 (US$86,493) on average, according to an analysis by eFinancialCareers, based on data from recruiters.

Corcoran cautioned on making a direct correlation between the salary levels as the reason for layoffs– although he did note that, with global banks’ investment banking activities becoming more regional in scope, banks may possibly opt to hire bankers in places where the salaries are not as high.

Trade, private banking stable

It has been a different hiring trend for other sectors. Corcoran noted demand for trade finance roles. “The actual traders, the sales traders, the trade support people that are booking trades and doing middle and back-office work; the trading arms of banks [are] where we’re seeing more activity,” he enumerated.

Wei noted demand for private bankers, although she did note that interview processes have “taken longer than traditionally” as their clients turn more cautious amidst the global outlook.

“Several local banks, Chinese banks, and Singaporean banks are strategically expanding their private banking services to align with Hong Kong’s growing family office sector,” she said.

Relationship managers and private bankers with connections to China’s wealthiest are in demand, Wei added.

“We do see various banks engage in overseas talent, in particular relationship managers with strong PRC connections and sustainable finance roles, given ESG (environmental, social and governance analysis) is quite new in the HK market,” Wei said.

Brain drain

One major challenge beyond investment banking which lenders in Hong Kong face is the limited talent pool, which has shrunk even more during the pandemic.

“A lot of young expats and people who were not permanent residents in Hong Kong did leave. Banks and people across the whole FSC industry are looking to replace that talent, but, because there hasn't been as much hiring, it's going to be hard to replace that until we have another higher volume recruitment cycle across the whole market to try to bring in that talent and significant numbers,” Corcoran noted.

Bankers from mainland China may help fill in this talent gap.

Wei noted that getting a work visa in Hong Kong has become more accessible for mainland Chinese professionals in recent years.

“Under [the Top Talent Pass] scheme, individuals from mainland China can secure a visa without needing immediate employment upon arrival. As a result, we’ve witnessed a notable increase in Chinese talent coming to Hong Kong in search of job opportunities,” Wei said.

Lion City’s attractiveness wanes

As for the future prospects of investment bankers, one thing is certain: they are probably not as keen to explore Singapore as they were a couple of years back.

There are still people looking to move from Hong Kong to Singapore, but not in the same numbers that they did kind of two years or 18 months ago, Corcoran said.

“During the lockdown there was a massive market of people looking to leave Hong Kong to go to Singapore. Now, not as much anymore. There’s a lot of constraints in the Singapore market: it’s tougher to get visas for non-Singapore nationals,” Corcoran pointed out.

Cost of living is another factor that has reduced Singapore’s attractiveness.

“Rent has gone up significantly; school places for expats are harder to come by as well. So, the attractiveness of Singapore during lockdown and COVID is somewhat waning, I think because of the reality on the ground,” Corcoran added.

-- with reports from Angelica Rodolfo

Advertise

Advertise