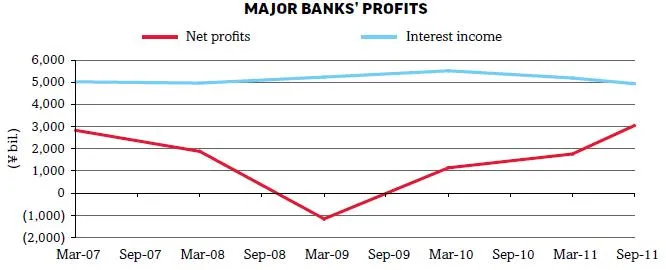

Japanese banks' net profits soared in 2011

Looks like Japan's banking sector managed to thrive in the midst of disasters.

According to Naoko Nemoto, primary credit analyst at Standard & Poor's, the credit quality of Japan’s banking sector has escaped largely unscathed from the sharp plunge in economic activity after the Great East Japan Earthquake in March 2011. Japanese banks boosted their net profits in 2011 as lower credit costs offset lower interest income.

"Although we expect Japan’s GDP growth in 2011 to come in at negative 0.9%, our base-case scenario calls for 2012 growth to recover to 2.0%. We expect reconstruction in disaster-affected areas and the revival of housing starts and other investments to boost growth, which could mitigate pressure from the global economic slowdown," she added.

Advertise

Advertise