GoTyme Bank partners with BSP to enable coin deposits

GoTyme Bank is reportedly the first bank partner to be integrated in the CoDMs.

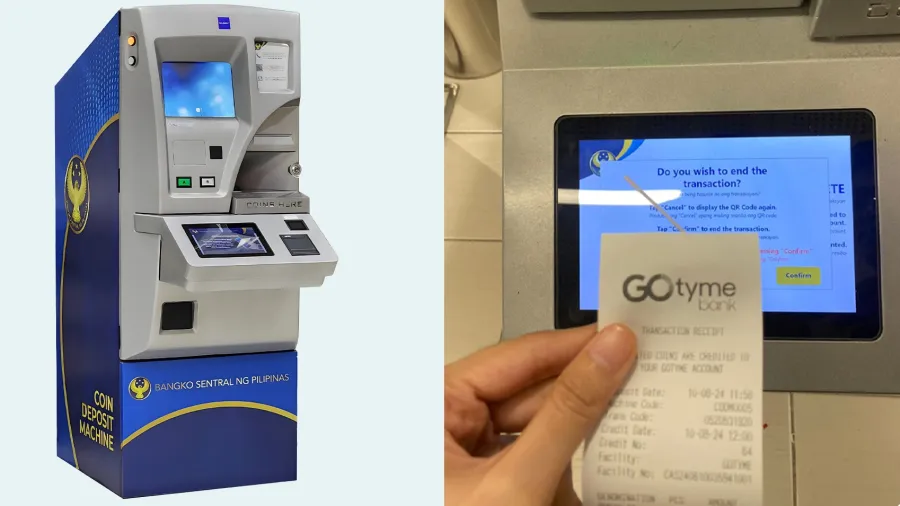

GoTyme Bank has teamed up with the Bangko Sentral ng Pilipinas (BSP) to allow its customers to deposit their coins and turn them into savings.

Customers of the Philippine digital bank can now use the BSP’s coin deposit machines (CoDMs) to deposit their loose change.

GoTyme Bank is reportedly the first bank partner to be integrated in the CoDMs.

After depositing the coins, the machine will generate a barcode to scan to credit the deposit in their GoTyme account. They can also enter the code manually.

The BSP launched the CoDM project on 20 June 2023 to address the artificial coin shortage and promote coin recirculation.

Advertise

Advertise