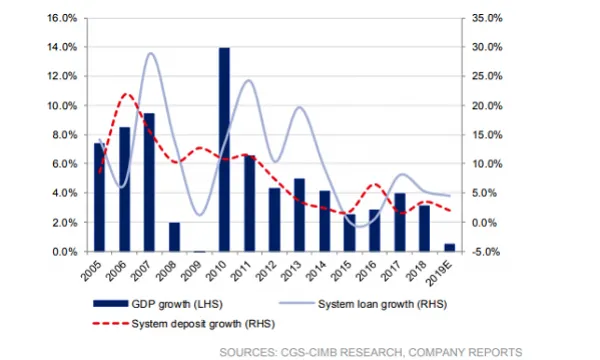

Regional credit growth props up bank loans as domestic lending falls flat

Loans to DBU trade-related segments and mortgages slowed.

Banks are relying on their regional operations to grow their loan portfolios amidst subdued growth in their home turf, according to CIMB.

Loan growth remained disappointing at 0.2% MoM or 4.4% YoY in July with regional gains offsetting the 0.9% MoM contraction in domestic credit. Business loan growth hit 0.4% MoM and 5.6% YoY in July led by building and construction, transportation, business services loans, data from DBS Equity Research show.

“Aside from the decline in loans to FIs, DBU (mainly SG-based) trade-related segments such as manufacturing and general commerce recorded the largest decline this month,” Andrea Choong, analyst at CIMB said in a report.

Also read: Singapore banks' loan growth to grind to a halt at 0.5% by end-2019

Domestic mortgage growth also shrank for the sixth straight month at -0.2% MoM and -0.8% YoY as weaker sales volume, particularly in the secondary market, hit monthly figures.

However, banks can rely on their regional exposures to support lending expansion, especially since a significant portion of their loan books comprise regional exposures as well as to China, noted Choong. The loan exposure of DBS to Greater China stands at 31% as of September 2018, according to estimates from Fitch Solutions. OCBC and UOB have loan exposure of 26% and 15% respectively.

Of its peers, UOB’s loan balances grew 4.2% in the first half of the year as the lender cashes in on its growing regional operations. “UOB’s ASEAN focus could see it benefiting the most from the potential diversion of production facilities out of Greater China,” said Choong.

Moreover, corporate loans are also expected to pick up the slack from slowing expansion of lenders' consumer finance arms, especially with pipeline deals and M&A transactions.

“Customers expanding overseas and drawdowns relating to en bloc transactions had held up OCBC’s loan growth in the past quarter. We believe corporate demand could be the supporting factor for growth in 2H19,” Choong said of OCBC.

The analyst also said the same of DBS as corporate loan drawdowns support the bank’s FY19 mid-single-digit loan growth target.

Advertise

Advertise