Singapore banks' loan growth slows to 0.2% in July

Consumer loans shrunk 0.1%.

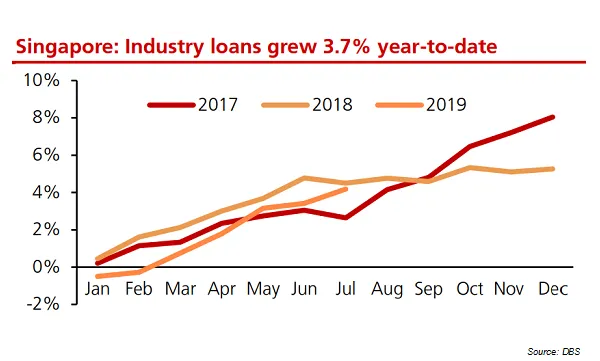

The growth of Singapore loan books continued to ease to 0.2% MoM in July from 0.3% in the previous month, according to DBS Equity Research. On a year-on-year basis, loan growth hit 4.4% amidst gains from ACU loans.

Year-to-date, loan books grew 3.7% in the first seven months of 2019.

Also read: Singapore banks' loan growth to grind to a halt at 0.5% by end-2019

Business loan growth continues to outpace consumer loans, growing at a pace of 0.4% MoM and 5.6% YoY led by building and construction, transportation, business services loans.

On the other hand, consumer loans shrunk 0.1% MoM but rose 0.9% YoY as mortgages continued to contract.

Also read: Singapore banks turn to corporates for loan boost as mortgages weaken

"As mortgage loans continued to decline for the sixth consecutive month (-0.2% m-o-m), DBS Group Research still does not expect the mortgage book to see a deep contraction unless there is an accelerated slowdown in the economy with massive unemployment," Rui Wen Lim, analyst at DBS said in a report.

In July, deposits grew 0.3% MoM and 8.0% YoY on the back of strong demand for fixed deposits. In the last two months, the cost of fixed deposits across banks in Singapore has fallen from the peak of around 2.0% to roughly 1.7% currently. "We believe lower cost of funding for banks may buffer some impact from lower loan yields should benchmark rates and loan yields fall," said Lim.

Advertise

Advertise