Staff Reporter

Mebuki's profits to improve but unrealised losses to rise

Mebuki's profits to improve but unrealised losses to rise

Its problem loans ratio is stable due to strong borrower quality.

Why tokenization and funding are two key issues for financial disruptors in 2024

HSBC's Vincent Lau a lineup of 250 speakers to discuss these at Money 20/20 Asia.

ING names ex-BofA Merril Lynch banker as APAC corporate finance head

Gautam Saxena also founded the venture capital fund Pegasus 7 Ventures.

Endowus launches full-service digital wealth platform in Hong Kong

It is also launching its flagship portfolios in May 2024.

SC Ventures, ENGIE Factory back conservation financing venture

The venture is expected to launch this year.

CIMB’s Dato’ Abdul Rahman Ahmad to step down as group CEO

CIMB has not named a successor yet.

Rising rates lift profitability of Japan’s 77 Bank

The same rising rates will increase the bank’s unrealized losses on its domestic bonds.

Funding to SEA fintechs drop 44% in Q1 but early-stage fintechs fly high

Funding to crypto firms more than tripled compared to Q4 2023.

Philippine National Bank’s profitability to improve on more SME loans

Liquidity is expected to decline as it accelerates lending in 2024.

Superapps to help drive BNPL userbase to 670 million by 2028

Superapps like WeChat and Grab are adopting and offering BNPL services to users.

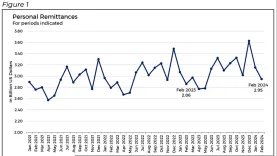

Overseas Filipinos’ remittances up 3% to $2.95b in Feb

A total of $2.65b in remittances coursed through banks, the central bank said.

Personal remittances from Overseas Filipinos (OFs) grew by 3% to $2.95b in February, according to central bank data.

APAC payments gateway market to rise 30% as cashless economy expands

The market is expected to grow by over 11% between 2023-2027.

Trading platform Banxso secures Australian license

It will offer real-time data, analytics tools, and educational resources.

Bangkok Bank bookmarked $1.09b in cash for Songkran 2024

The cash was expected to have served over 8,000 ATMs and branches.

Revised rules bolster car loans but with influx of lower quality borrowers

The asset quality of auto finance companies will be tested.

Weak home sales risk worsening Chinese banks' bad loans

Banks’ property loan exposure is expected to fall 6% amidst ongoing caution.

Thailand’s SCB, SCG offers green loans for net zero buildings

The loan will help entrepreneurs transition their buildings to net zero structures.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership