Banking Technology

CIMB tests tokenised sukuk under Malaysia’s digital asset hub

CIMB tests tokenised sukuk under Malaysia’s digital asset hub

It will evaluate bank-grade tokenisation across issuance, payment, and settlement.

3 days ago

Maybank pilots tokenised ringgit for cross-border payments

The bank aims to pioneer a range of tokenised assets, from Islamic finance to wealth products.

3 days ago

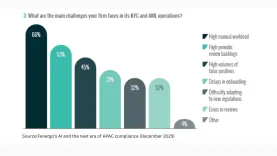

Half of APAC banks hit KYC backlog as manual systems fail

In Singapore, nine institutions were fined a combined $21m for anti-money laundering failures.

ANZ rolls out agentic AI CRM tool that will save bankers 1 month of time

The new CRM consolidates data from 20 different platforms.

Only 1 in 10 banks see AI returns despite $97b spend by 2027

Data fragmentation and governance uncertainty plague most AI adoptions.

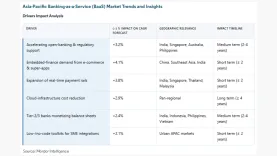

APAC BaaS market to reach $5.3b as embedded finance surges 148%

Regional revenue is set to climb from $4.44b in 2025 to over $12b by 2031.

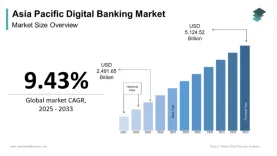

APAC digital banking market to hit $5.12t by 2033

Market Data Forecast projects a 9.43% CAGR through the next decade.

India’s ESAF Small Finance Bank modernises onboarding and lending

It expects to optimise IT costs and see lower licensing costs.

Macquarie Bank launches new AI-powered chat agent

It can answer common customers' questions and requests and escalate to a team member.

Siam Commercial Bank to perform maintenance on international fund transfers

SCB Easy App users will not be able to use the service during this period.

Digital transformation starts with leadership

When employees understand the “why” behind a change, digitalisation becomes a shared journey rather than a top-down mandate.

Banks pour into digital asset infrastructure, Sygnum says

Self custody could shift $300b off platforms by end 2026.

Ant International and Google to soon enable AI checkout in chat

The UCP establishes a common language for agents and systems to operate together.

MUFG deploys real-time anonymization across unstructured data

On-premises processing keeps MUFG data off external clouds

Agentic AI to reshape Asian banking, report says

Agentic and multiagent AI boost banking efficiency and cut costs.

Singapore banking sector adapts to AI, digitalisation in 2026

AI adoption, talent demand, and digital skills shape banking 2026.

The future of Asian banking isn’t ‘AI-first’ – it’s ‘fearless-first’

The biggest temptation is to treat AI as a “bolt-on feature.”

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership