News

Mizuho hits 90% of profit target in 9 months as net income tops $6.4b

Mizuho hits 90% of profit target in 9 months as net income tops $6.4b

Its expanded share buyback shows confidence in its capital base.

Malaysian bank loan growth to stabilise at 4.5% to 5.5% in 2026

The 2025 slowdown to 4.8% seen as normalisation after 2024’s 5.5% expansion.

Techcombank net profit climbs 17.5% to $973.36m in FY2025

Q4 net profit nearly doubled on higher interest income and fee income.

Mastercard launches Fleet: Next Gen to streamline fleet payments in APAC

It offers acceptance in a million locations and data gathering capabilities.

Close gov’t supervision driving Evergrowing Bank risk upgrades

S&P flags legacy loan strain despite Shandong oversight push.

Westpac hikes home loan rates as it flags budget pressure

Westpac's consumer chief executive recognized that the increase may add pressure to households.

Japan Post Bank flags $23.47b unrealised securities losses to Dec

The book value of the securities is JPY29.86t.

Norinchukin fortifies JA Mitsui Leasing after $968m fraud allowance

Norinchukin is in talks with SMBC and other major banks to provide loans to JAML.

MUFG launches the Slim Course pension plan in iDeCo system

It offers zero management fees and aims for the industry’s lowest operating costs.

SMBC signs SBI pact to back India sunrise sector project finance

They aim to grow India’s “sunrise sectors”.

Philippine banks signal credit squeeze as tightening bias grows in Q1

About 12.8% of banks expect to tighten credit standards for household loans.

SMFG profit up 22.8% to $8.99b in 9M on higher income

It forecasts an annual cash dividend of JPY157 for the fiscal year.

Korea revises bill to check criminal info of virtual asset service providers

The law also broadened rule-breaking activities that are screened.

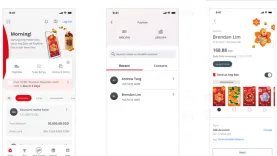

E-ang bao use jumps nearly 50% in 2025 as seniors ditch red packets: OCBC

Nearly 8 in 10 seniors were first-time e-ang bao senders, OCBC said.

DBS Hong Kong names Xu Qing as managing director and risk head

Xu will oversee all credit and risk functions in Hong Kong, mainland China, and Taiwan.

Failed P&N-CUA merger won’t slow Aussie mutual bank consolidations: S&P

The two banks are expected to continue seeking consolidations.

PNL and Great Southern Bank scrap merger

The two Australian banks’ boards agreed to terminate their MOU.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution