Banks should use the right AI for the job

The proper solutions improve operations at a cost-effective price.

Banks seeking to incorporate artificial intelligence (AI) in their operations should use the right model for the job to maximise its value, according to an analyst.

“Essentially, do not use a high-code, large language model for a simple task,” Christopher Saunders, a partner and head of advisory and financial services at KPMG International Ltd Thailand, told the recent Asian Banking & Finance-Insurance Asia Summit in Thailand. “It will cost you more.”

Companies should also look at their data quality.

“Clean your data before starting your project, and do not underestimate the investment required for this cleansing process,” he said. “Factor it into your budget upfront and ensure you have the necessary storage and data transfer systems.”

Successful large-scale change hinges on employee adoption — the difficult “last mile” of implementation, Saunders said. Trust, particularly regarding cybersecurity and data privacy, is crucial to drive this adoption, he pointed out.

Naris Sathapholdeja, chief of the data and analytics group at TMBThanachart Bank, said they use generative AI (genAI) to enhance personalisation and communications and create precise messaging for customers.

“Each of the bank’s 10 million customers receives personalised insights, including simple reminders to pay bills or recognise transfer patterns,” he said.

From a business standpoint, this not only ensures better financial planning for each person but also boosts company sales, Sathapholdeja said.

“Through our digital transformation journey, 30% of value creation comes from predictive AI and 10% from genAI, which creates a real business impact and delivers justifiable return on investment,” he added.

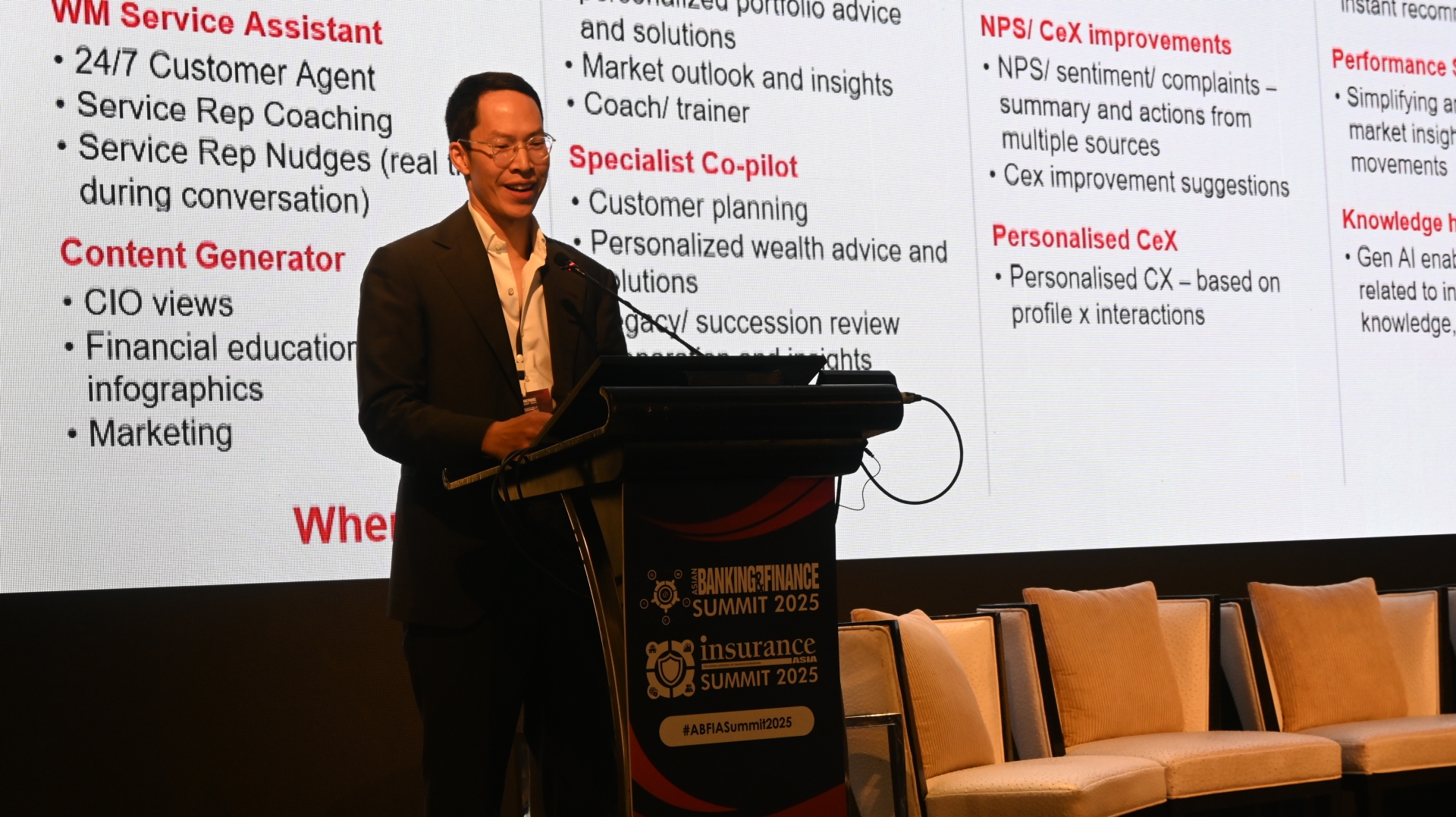

Thanat Chamnanratanakul, an associate partner at Bain &Company, cited genAI’s growing role in wealth management.

“Thailand's mass affluent and retail segments account for over 40% of the total assets under management, with 27% of these in mutual funds,” he said. “There is still considerable room for market penetration.”

Whilst financial institutions use genAI to streamline operations and enhance advisory services for assets under management, Chamnanratanakul said even tech giants like Apple have moved slowly in deploying AI products, ensuring that they are accurate and reliable.

Advertise

Advertise