Hiring freeze felt as HK banks focus on talent development

Many senior roles in banking get cut, but relationship managers, private bankers, and tech roles remain sought after.

Bankers seeking a job in Hong Kong should brace themselves for obstacles as financial institutions slowed investment for human resources.

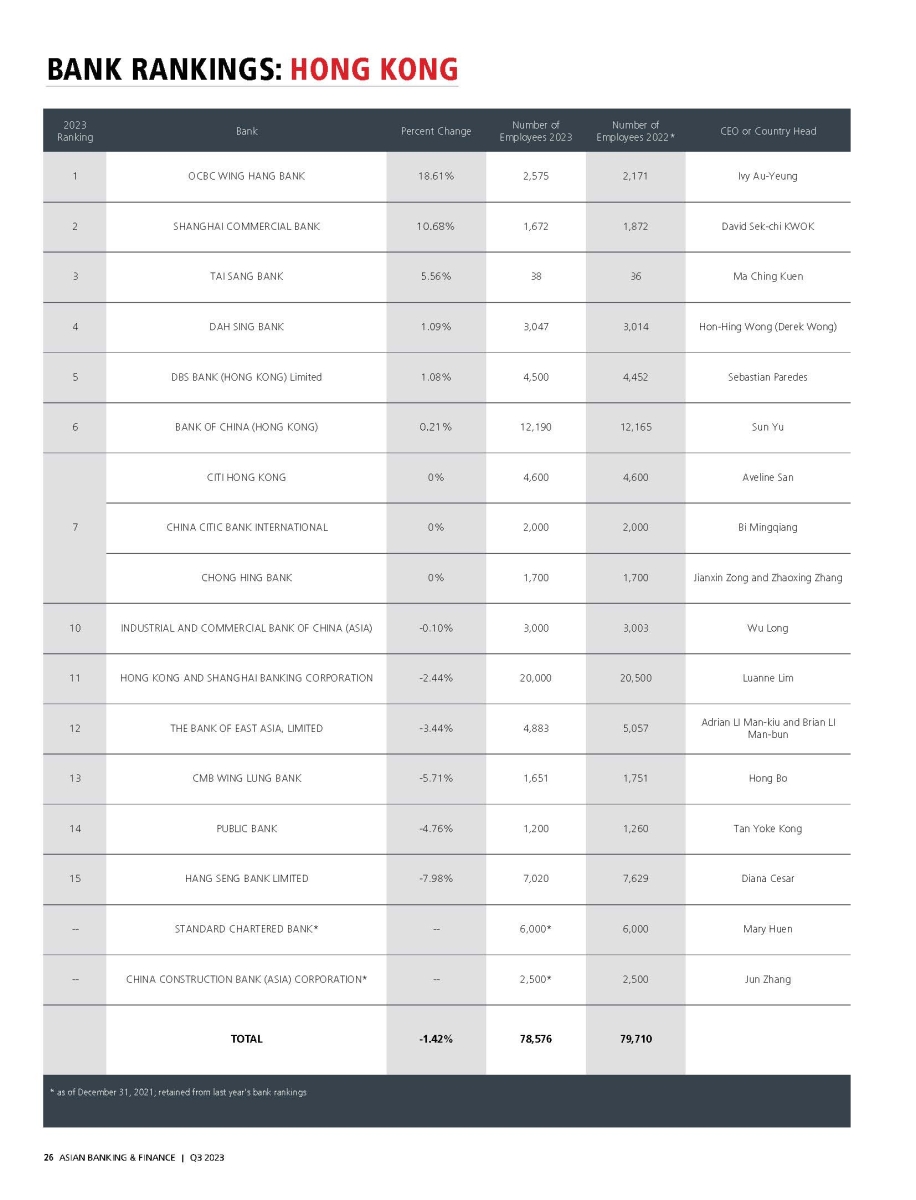

The year 2022 saw hiring slow down and roles get cut, although the overall numbers did not dramatically fall. Data gathered by Asian Banking & Finance revealed that there are a total of 78,576 individuals working across 17 banks in the city as of end-2022—a marginal drop from the 79,710 people employed in the same banks by end-2021.

HSBC, Bank of China (Hong Kong), and Hang Seng Bank remain the three largest banks in Hong Kong in terms of the number of people employed. HSBC and Hang Seng Bank had slightly lower headcounts compared to the past year. Based on the numbers, HSBC cut another 500 jobs in Hong Kong; whilst Hang Seng Bank’s headcount fell by 600 people.

Responding to Asian Banking & Finance queries, Hang Seng Bank — which is celebrating its 90th anniversary this year — said it is now focusing on talent development and equipping the workforce with future-oriented skills.

“People are our most important asset. We continue to invest in developing our colleagues through structured programmes and equip them with future-skills to support their growth. We maintain an agile approach to people resources management to meet business needs and build talent pipelines,” a spokesperson from Hang Seng Bank stated through official e-mail correspondence.

“One of the examples is recruitment through graduate and management trainee recruitment programmes. We also focus on promoting our talent development priorities, especially for local talents, to cultivate young talents to become banking professionals,” the spokesperson added.

Bank of China (Hong Kong), meanwhile, hired more people over the past 12 months, keeping 12,190 in its employ as of end-2022.

OCBC Wing Hang Bank, DBS Hong Kong, and Dah Sing Bank all employed a slightly higher number of people by the end of 2022 compared to the previous year. OCBC Wing Hang added over 400 new people to its Hong Kong team; DBS Hong Kong’s total employee count is over 50 people higher than in 2021; and Dah Sing Bank saw its workforce numbers rise by over 30 people.

Tai Sang Bank, the smallest bank in the rankings, now employs 38 people versus the 36 employees it had in 2021. Tai Sang Bank operates out of a single branch at Des Voeux Road Central and does not offer any online banking or ATM services.

The rest of the banks saw their numbers fall or remain the same. The Bank of East Asia, Limited saw their headcount fall below 5,000 people to 4,883.

Chong Hing Bank roughly employed the same number of people by end-2022 compared to a year earlier but moved up two spots in the rankings of largest banks by employee count as both Shanghai Commercial Bank and CMB Wing Lung Bank cut numbers in 2022.

Shanghai Commercial Bank employs 200 people less as of end-2022, and CMB Wing Lung Bank 100 people less.

Of the five banks in the Hong Kong Bank Rankings with the largest staff employed in the city, Standard Chartered Bank was the only one that did not disclose its numbers as of press time.

Media reports in early June alleged that the bank has begun laying off employees across Singapore, London and Hong Kong as part of an existing plan to cut costs by more than $1b in 2024, with the number of jobs cut possibly exceeding 100.

Hiring freezes, productivity focus

Hiring experts told Asian Banking & Finance that there is an informal hiring freeze and some layoffs, as Hong Kong banks focus on maximizing productivity rather than hiring new employees.

“Over the last nine months, it’s [hiring] definitely slowed down. And then over three months [in 2023], it slowed even further, especially in the wake of happenings in the global investment banking market,” said John Mullally, Robert Walters’ managing director for Hong Kong and South China.

Investment banking layoffs have hit the shores of Hong Kong, although not as much as New York and London. Mullally, in particular, noticed an amount of layoffs at the senior levels.

“What was seen during the global financial crisis were huge swathes of bankers losing their jobs. We are definitely seeing some layoffs, especially at the senior levels, which are more visible, more noticeable,” Mullally said, adding that whilst there are no “formal” hiring freeze announcements, there was definitely an “informal hiring freeze [or] less hiring activity in general.”

Instead of hiring, banks are focused on maximizing the productivity of their workforce.

Olga Yung, managing director at Michael Page Hong Kong, said the majority of companies and hiring managers have as their key priority the improvement of cost efficiency and productivity in 2023.

“This is a common theme across a variety of sell side players regardless of size,” Yung told Asian Banking & Finance via exclusive correspondence.

RMs, tech roles still in demand

Whilst hiring has slowed down due to overall weak market sentiment and negative news coming out in relation to various banks, there are still some roles that are in demand for banks.

“Across the sell side, mid to back office operations, compliance risk, finance and audit are constantly in demand for talent,” Yung said. Private bankers and relationship managers from retail banks are also sought after.

“If you’re a relationship manager (RM) who can bring in assets, who can move clients, there’s still a demand for that. But outside of that, [the demand] is not particularly active,” Mullally said.

Banks are also still looking into hiring quality developers and programmers, as this is a shallow talent pool in Hong Kong, he added.

In 2022, ESG and crypto were two “hot topics” in hiring, Yung said. ESG remains a hot talking point, but candidates will need relevant exposure to be considered in these positions.

“Before [the] crypto winter arrived, anyone who had experience or interest in crypto is a prospective candidate to the countless digital asset players which have emerged in the market over the recent few years. We saw high levels of hiring and interview activities across the majority of 2022, until the last quarter,” Yung said.

Too little, too late

In 2022, the strict travel rules reportedly drove bankers and experts away from Hong Kong. It has since lifted its strict travel restrictions, but the effect is unfortunately nil.

“It definitely increased confidence in the market. The problem is, it happened after the financial services and the investment banking markets really slowed down hiring because of the broader geopolitical challenges in the world and broader economic challenges, such as the looming threat of a global recession,” Mullally said.

“The lifting of the quarantine was very much welcome for Hong Kong as a place for employers and employees. But the challenge now is that not many financial services firms are hiring and they’re certainly not hiring near the level that they hired in 2021,” he added.

Advertise

Advertise