Digital payments clock 13% growth as physical cards retreat

Super-apps reduce dependency on traditional products by bundling diverse financial tools.

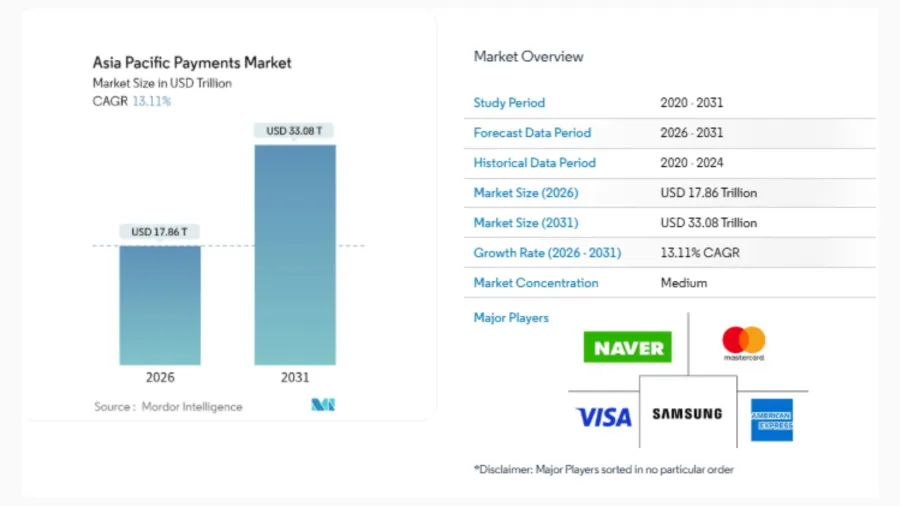

The Asia-Pacific (APAC) payments market is expected to grow to $17.86t in 2026, reaching $33.08t by 2031, a report by Mordor Intelligence showed.

This also means a compound annual growth rate of 13.11% over the 2026 to 2031 period. For last year, the payments market was valued at $15.79t.

Growth is being driven by the wider use of digital payments, high smartphone penetration and the expansion of government-backed real-time payment systems.

Super-apps are playing a central role by offering payments alongside other financial services, reducing reliance on traditional card products.

Cross-border QR payments and account-to-account links are also gaining ground, cutting settlement times and lowering costs for merchants.

In response, card networks are increasing the use of tokenisation and forming partnerships with local wallets to retain transaction data, even as physical card use declines.

Online retail sales in APAC rose sharply in 2024, with mobile payments accounting for more than 70% of digital commerce in China and India.

Rising cross-border shopping is pushing merchants to support multi-currency checkout, real-time foreign exchange and smarter routing to avoid high correspondent banking fees.

Payment orchestration platforms are expanding the use of unified application programming interfaces, allowing merchants to switch payment methods or acquirers to improve approval rates and reduce costs.

At the same time, more complex fraud is prompting higher spending on artificial intelligence-based risk systems.

Public-sector payment infrastructure continues to shape the market. India’s Unified Payments Interface processed 131 billion transactions in 2024, while Thailand’s PromptPay exceeded 15 billion transactions.

These systems have lowered transaction costs and shortened settlement times.

In Singapore, programmable money trials under Project Orchid are testing automated functions such as tax collection and escrow within payments.

Central bank oversight of these systems is increasing competition, forcing private players to focus on additional services rather than control of payment rails.

Advertise

Advertise