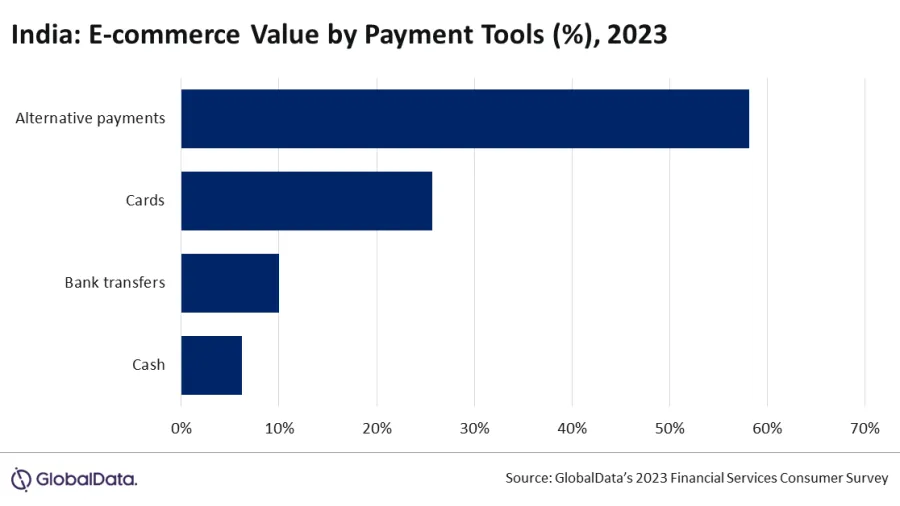

1 in 4 e-commerce transactions in India use alternative payments

Cash makes up barely 1 in 10 of transactions, according to GlobalData.

Alternative payment solutions are consistently gaining popularity amongst Indian e-commerce customers over the past 5 years, reports data and analytics company GlobalData.

Payment cards have emerged as the second most popular e-commerce payment method in India, making up 1 in 4 (25.7%) of all e-commerce payments in 2023. Popular brands include Amazon Pay and Google Pay.

Credit and change cards, meanwhile, accounted for 15.4% of the share in the same year.

Cash now only makes up 6.2% of online purchases in India.

ALSO READ: Mastercard and Alipay enable real-time remittance in over 180 markets

The rise of mobile e-commerce payments was thanks to government initiatives such as “Make in India” and “Startup India”, as well as the rise of online shoppers, GlobalData said. E-commerce retailer Flipkart anticipates that its online shopper base in India will increase to 400 million to 450 million by 2027.

“The uptrend in e-commerce sales in India is likely to continue over the next few years supported by the growing consumer preference, improving payment infrastructure, and growing popularity of alternative payment solutions with these solutions dominating the ecommerce payment space over the next few years,” says Ravi Sharma, lead banking and payments analyst at GlobalData.

Advertise

Advertise