Indian banks' IT spending to hit $9.1b in 2017

Devices spending in the sector will grow the fastest at 20%.

The transition of the Indian banking sector to a cashless society is creating many opportunities for technology investment in digital payments infrastructure, according to Gartner, Inc. IT spending by banking and securities firms in India will increase 11.7 percent in 2017 to reach $9.1 billion.

Here's more from Gartner:

Several top banks in India are investing heavily in contactless payment, which uses near field communication (NFC) mechanisms, which is also propelling investment in devices.

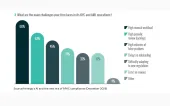

Devices spending in the Indian banking sector will grow the fastest at 20 percent in 2017, followed by IT services at 15.8 percent. Firms in the banking and securities industry are investing more in devices to upgrade their existing infrastructure.

“Indian banks are getting back on track after slower IT spending the last two quarters, which was prompted by demonetization,” Moutusi Sau, principal research analyst at Gartner. “However, as banks focus on enhancing the legacy infrastructure and making digital transformation the primary goals for the banks, we will see more investments flow into newer concepts like artificial intelligence (AI) and blockchain.”

“Financial services firms are lagging behind global top-performing organizations in relation to digital transformation. They hope that doing ‘more of the same’ will equate to improved performance,” said Rajesh Kandaswamy, research director at Gartner. ”As organizations seek digital maturity, As digital leaders, financial services CIOs need to focus their firms' participation in an expanded ecosystem that includes competitors, customers, regulators and other stakeholders from across multiple industries.”

Advertise

Advertise