Chinese banks post loan recovery in March, but further growth unlikely

A fiscal stimulus is needed to spur demand.

The Chinese banking sector recorded $404b (RMB2.85t) in new loans in March but further growth is unlikely without a fiscal stimulus that will create demand, according to a Jefferies report.

Both new long- and short-term corporate loans bloomed in March, with Q1 short-term loans doubling compared to the same period in 2019. Key drivers include large banks and policy banks, mainly towards state-owned enterprises (SOEs) and manufacturing, as well as delayed February demand due to the lockdown.

Short-term working capital demand due to rebounds in production and trading and virus-fighting loans supported by the People’s Bank of China (PBOC) also contributed to the growth.

Consumption loans also posted recovery, with mortgage loans returning to normal levels as property sales rebounded. New ST residential loans also recovered due to improvement in consumption which was supported by government vouchers, but loan balance still dipped QoQ in Q1.

However, a 14% and above loan growth is improbable given that Q1 loans were mostly issued by banks, with growth helped by loans approved but not issued in 2019, virus-fighting loans, infrastructure loans, and SOEs willing to lift their loan balance for a lower yield, the report said.

“Without fiscal stimulus that artificially creates loan demand, we see limited loan growth drivers going forward, given slower economic growth on low FAI growth, consumption and export,” the report added.

Q2 2020 is expected to be harder for loan targets, making it the ideal time for a stimulus, Jefferies said.

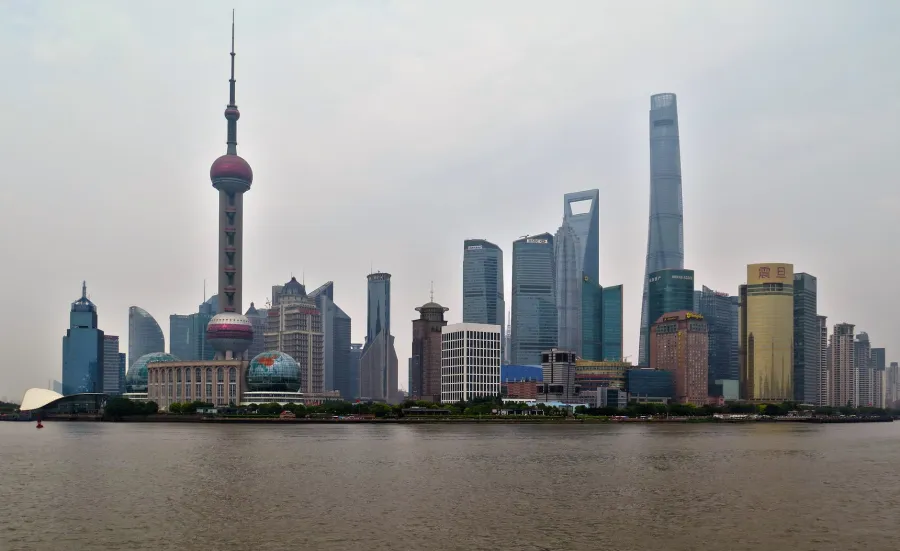

Photo courtesy of Pexels.com.

Advertise

Advertise