Lending & Credit

Chinese state banks’ enhanced policy roles increases support prospects

Chinese state banks’ enhanced policy roles increases support prospects

Banks are expected to log moderate credit growth and no increase in risk appetite.

South Korea’s household loans rise at a slower pace in March

Mortgage loans grew, but other types of loans shrank during the month.

Vietnam records 3.93% credit growth in Q1

Lending interest rates decreased 0.4% compared to end-2024, the SBV said.

JuanHand drives embedded lending with e-commerce tie-ups

The lending app only requires an ID, a smartphone, and an internet connection.

APAC developed market banks to see limited loan growth, NIM pressures

Hong Kong is expected to see even slower loan growth than other DM markets.

Chinese banks face $341b annual credit losses from tariff strains

Banks’ nonperforming assets are expected to peak at 5.9% in 2026.

Softening property demand could push up Taiwan’s bad loans

Potential losses could be absorbed by the banks’ core earnings, S&P said.

Krungthai Bank links Thaoil’s FX hedging transactions to ESG

Thaioil can get discounts if it successfully meets its ESG goals.

Philippine lending app JuanHand, Netbank team up to offer business loans

The loans will be tailored to the businesses’ specific needs, the two fintechs said.

China’s Big 5 banks expected to boost lending with capital support

Fee income may also recover if new stimulus policies are effective, said CreditSights.

Philippine bank loans up 12.2% in February

Consumer loans to residents rose by 24.1% during the month.

India tightens microfinance rules to curb borrower overleveraging

Lending in the sector has slowed down as tighter rules began rolling out in 2024.

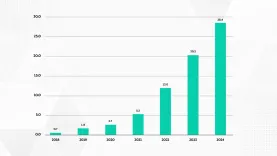

Chart of the Week: 1 in 4 Filipinos have used BNPL services

The number of unique users rose by 40% as of end-2024.

India revises priority sector lending guidelines

It broadened the purposes for renewable energy loans and revised UCB targets.

Mannapuram Finance gets growth boost from Bain Capital’s stake acquisition

It will enable the Indian gold lender to invest in new age tech like AI, for example.

RBI Governor tells urban cooperative banks not to break depositors’ trust

Malhotra stressed the importance of maintaining high standards for customer service.

SCB X eye more profits from Gen 2 firms as Thai corporates cut bank loans

Its banking services loan portfolio contracted in 2024, whilst those from Gen 2 expanded.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership