Lending & Credit

India’s private banks to widen gap with state peers when economy rcovers: report

India’s private banks to widen gap with state peers when economy rcovers: report

Investors will likely seek signs that private lenders will be able to step up lending once COVID subsides.

'Buy now, pay later' speaks to convenience as more Filipinos remain unbanked

Bypassing credit cards, the payment instalment options prove to be attractive.

China’s central bank rolls over $15.46b maturing mid-term loans: report

Fund injection is meant to keep banking system liquidity reasonably ample, PBOC said.

Mortgage loans drive up South Korean banks’ household loans in June

They also set a fresh record for half-year increase in household loan value.

Bangladesh’s City Bank clinches $30m trade finance loan with UK’s CDC

It will be used to extend foreign currency trade to local banks and businesses.

Indonesian banks’ risks rise as new wave of infections dampen economic recovery

The rising number of COVID cases will delay the return to normal repayment schedules.

South Korean banks to tighten fresh lending in Q3

Rising household credit risks and tougher lending rules put a damper on lenders’ plans.

South Korean incumbent banks’ profits at risk as Kakao Bank expand loan services

The internet-only bank plans to launch mortgages and merchant loan products.

IFC grants $40m loan to Vietnam’s SeABank to expand SME lending

It’s the first phase of a $150m package for expanding SME lending, reducing greenhouse gas emissions.

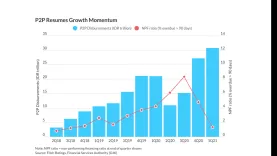

Indonesia mulls tightening fintech, P2P regulations

New regulations may include higher capital hurdles for P2P players.

Security Bank’s SB Finance launches Car4Cash in the Philippines

Car owners can gain access to as much as PHP2m.

Local bond market’s problems heighten Chinese banks' credit risks

The bond market’s repayment woes may force banks to make concessions for the sake of financial stability.

Baiduri Bank’s margins likely tepid in 2021, but with profits satisfactory: S&P

The bank is expected to see moderate credit growth and satisfactory profits.

Public Bank reassures COVID-hit loan customers it will continue to offer support

The bank has assisted over 160,000 customers affected by the pandemic.

Taiwanese bills finance companies to be unaffected by recent COVID surge: Fitch

The country’s economic resilience has eased BFCs’ operational pressures.

Standard Chartered grants first green banker’s guarantee in ASEAN

ENGIE is building an underground district cooling system for Singapore.

South Korea’s Hana Bank floats $600m in ESG bonds: report

It carries an annual interest rate of 1.25%.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership