Vietnam’s Cake Digital Bank achieves profitability

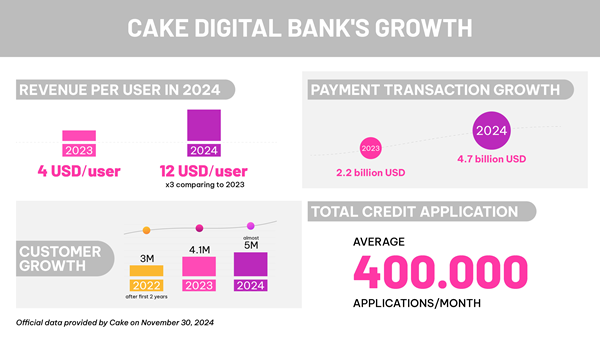

Revenue per user is US$12 in 2024, and payment transactions are $4.7b.

Cake Digital Bank has achieved profitability, 3.5 years after its first launch.

In a press release, the digital-only bank said that it is the first digital bank in Vietnam to achieve this milestone.

Revenue per user reached US$12 in 2024, a threefold increase from the US$4 per user it recorded in 2023.

Cake Digital Bank’s client base has also expanded from 3 million in the first 2 years to nearly 5 million in 2024.

Cake said that it now processes an average of 400,000 credit applications monthly.

The digital bank’s payment transaction growth reached US$4.7b in 2024, doubling the US$2.2b recorded in 2023.

Its customer retention rate is reportedly at 80% based on transaction frequency, and 95% based on financial engagement.

The bank now aims to position itself within the top 5% of the world's most profitable digital banks.

By 2024, about 77% of Vietnamese adults will have bank accounts, according to a report by The State Bank of Vietnam.

Cake Digital Bank’s name comes from the term “easy as cake”, a slogan that promises quick account setup and instant money transfers.

Advertise

Advertise