Frances Gagua

Indonesia banks see NPLs climb on mortgage and vehicle loan strain

Indonesia banks see NPLs climb on mortgage and vehicle loan strain

CGSI said that banks should be more cautious of auto loans than mortgages.

Wholesale lending to lift Indonesian banks’ loan growth

Average loan growth is expected to rise to 9% in 2026.

Syfe achieves group profitability

Its AUM in Hong Kong grew nearly six-fold in 2025.

KBANK sees limited flood impact as interest income pressure looms

Policy rate cuts will lead to net interest income pressures in 2026.

TISCO Bank cautious on 2026 as it scales back high yield lending

It expects net profits to decline in 2025-26, but is confident it can maintain its payout ratio.

Thai Credit Bank eyes double digit loan growth in 2026

It expects to hire more employees to support its larger loan portfolio.

APAC banks in stronger capital positions than global peers

Regulators have more conservative local rules.

NAB Private Wealth names Alexandra Campbell as new CIO

Campbell will lead the investment strategy across all asset classes and JBWere.

Airwallex secures majority ownership of PT Skye Sab Indonesia

Indonesian merchants wanting to expand overseas can now do so via Airwallex.

KPay, Global Payments launch ‘Tap to Pay on iPhone’ service

Merchants can accept contactless payments using an iPhone XS or a later model.

Wealth managers expand lifestyle offerings to capture UHNWs

UHNW-focused practices are more likely to offer concierge and lifestyle services.

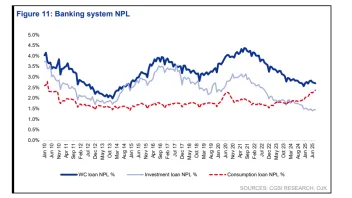

Indonesian banks’ weak loans improve with ample coverage for risks

Pockets of vulnerabilities remain in certain sectors, like the textile industry.

Thailand backs major conglomerates for digital banks but risks stifling innovation

Did the Bank of Thailand play it too safe by going for large, established conglomerates?

Endowus rolls out two investment portfolios in HK, SG

Income Enhanced Conservative and Income Enhanced Aggressiveness are now available.

Alipay+ sees tourist spending rise on foreign e-wallet use

Beauty clinic transactions and transportation transactions rose during the year.

CBA pays $525,000 in penalties for data sharing contraventions

Some customers may have been unable to share certain data to accredited recipients.

StanChart enables Ascentium clients to easily open accounts in Hong Kong

Ascentium clients can also access StanChart’s referral network in Asian markets.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership