Frances Gagua

What makes Malaysia and India more creditor friendly than the Philippines?

What makes Malaysia and India more creditor friendly than the Philippines?

The Philippines is ‘unpredictable’ in enforcement of laws and resolution time.

Thousands of Aussie financial advisers fall short of 2026 rules

Over 2,300 advisers or providers risk losing authorisation on 1 January 2026.

Taiwanese banks’ profitability to weaken in 2026 as loans and wealth sales slow

Wealth management sales may moderate.

Fiuu unveils tap-to-pay contactless payments on iPhone

Merchants must have the Fiuu VT iOS app and at least an iPhone XS.

HitPay and Visa to expand Philippine SMEs’ payment acceptance

SMEs can process both in-store and online transactions without a bank contract.

MAS expands Ripple’s scope of payment activities in Singapore

Ripple uses digital payment tokens to offer end-to-end payment solutions.

Citi names Yuko Nakayama as head of ECM for Japan investment banking

The ECM team in Japan will report to Nakayama.

Westpac to enable subscription viewing and cancellation in app

3 in 10 Australians say they are wasting money on duplicate or unused subscriptions.

MAS cracks down on influencers promoting financial products

Seemingly educational content or advice can cross into regulated territory.

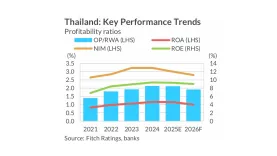

Thai banks brace for weaker 2026 earnings as rate cuts hit margins

Loan growth may pick-up but likely to stay in single digits, says Fitch.

Singapore and Japan renew bilateral swap arrangement

They can exchange local currencies of up to S$15b or JPY1.1t.

CIMB’s net profit up 2.34% to $502.6m in Q3

Non-interest income rose by over 20% during the quarter.

OCBC to enable scan and pay on all China merchant QRs by Q1 2026

By then, OCBC app users can pay via Alipay, Weixin Pay, and UnionPay.

ICBC to meet increased capital req’s after G-SIB upgrade: S&P

Its 21.52% TLAC already exceeds the new minimum requirement

Australia’s new mortgage caps unlikely to hit bank credit growth

The new limit may mitigate risks of significant increases in household debt.

Banks struggle to keep pace as fintechs scale agentic AI

Most incumbent initiatives are defined by narrower applications.

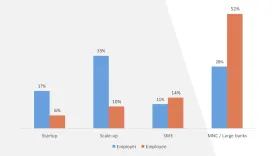

Singapore’s fintechs see mismatch between talent and hiring demand

Startups and scale-ups are the biggest employers whilst talent comes from MNCs.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership