Lending & Credit

South Korean bank delinquencies hit 0.6% with SMEs hit hardest

South Korean bank delinquencies hit 0.6% with SMEs hit hardest

Volume of newly delinquent loans shrank whilst resolved loans rose.

Korea’s outstanding deposit rate fell in December whilst loan rates climbed

Rates for new deposits rose during the month.

Motilal Oswal profit skyrockets 65% on record operating surge

The India financial services company saw asset and private wealth growth.

China bank asset quality risks surge on state lending

Relending rates fell by 25 bps to relieve funding pressure on micro and small enterprises.

Kiatnakin Phatra Bank's profit jumps 26.1% but loan book shrinks in Q4 2025

Its net profit of $190.06m is 18.6% higher compared to a year earlier.

Chinese banks defy Vanke contagion as S&P forecasts 4% growth

Weak-loan ratios are currently performing better than the agency had previously anticipated.

Moneymax launches credit push as 95% of Filipinos “credit invisible”

The company will release guides and hold webinars in partnership with the CCAP.

4 APAC markets face 'declining' outlook as loan yields retreat: Fitch

Any resulting drag on the operating profit and RWA should be manageable.

Natixis CIB names Jarek Olszowka as APAC head of green & sustainable hub

He was the international head of sustainable finance for a major Japanese financial services group.

DBS Hong Kong unveils new SME sustainable finance program

Eligible uses include energy efficiency upgrades, resource conservation, and clean transportation.

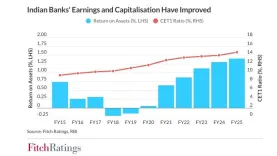

Indian banks hit decade-high returns but profit set to soften

Some of the more recent reforms are untested through a down-cycle, said Fitch.

Taiwan banks add $6.69b loans in November as bad debts tick up

The average NPL ratio is 0.16% with bad loans rising by $0.06b.

Indonesian banks’ credit costs may stay high in 2026 on weather risk

Major banks should still be able to deliver positive earnings growth of 1%-7%.

Australia’s big four banks loan deferrals, waive fees for bushfire victims

NAB is providing A$1,000 grants and additional financial relief, for example.

MUFG invests $4.3b in India’s Shriram Finance

MUFG is subscribing to a preferential allotment of 20% equity shares in the NBFC.

India credit card spending grows 11.5% in November on e-commerce

The number of outstanding credit cards rose to 11.5 crore in November 2025, up from 10.7 crore a year earlier.

Philippine FCDU loans fall 3.9% in September 2025

This is despite the 5.7% growth in deposits in foreign currencies, the central bank said.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership