Lending & Credit

Australia’s big four banks loan deferrals, waive fees for bushfire victims

Australia’s big four banks loan deferrals, waive fees for bushfire victims

NAB is providing A$1,000 grants and additional financial relief, for example.

MUFG invests $4.3b in India’s Shriram Finance

MUFG is subscribing to a preferential allotment of 20% equity shares in the NBFC.

India credit card spending grows 11.5% in November on e-commerce

The number of outstanding credit cards rose to 11.5 crore in November 2025, up from 10.7 crore a year earlier.

Philippine FCDU loans fall 3.9% in September 2025

This is despite the 5.7% growth in deposits in foreign currencies, the central bank said.

Indonesia’s big four banks to hit 9.3% loan growth in 2026

Wholesale loans and microloans will growth during the year.

Australia big four banks hold majority of loans in mortgages

CBA and Westpac have the largest proportion of mortgages relative to their gross loans.

NBFIs see outlook stabilise as funding conditions normalise

Chinese NBFIs are expected to benefit from improved risk profiles and policy alignment.

PNB inks loan facility agreement with DCFC to boost SME lending

The facility will be used to grant working capital loans to SMEs.

Which structured finance market in APAC will fare best?

Fitch sees stable to improving asset performance in ANZ and Japan as China slips.

Malaysian banks see lending growth soften ahead of year end

Deposit growth improved whilst loan growth may be around 5% for 2025.

NAB offers loan relief, fee waivers to Aussie bushfire victims

Those directly impacted may also be eligible for credit card payment deferrals, amongst others.

Philippine bank lending up 10.3% in October

But loans to non-citizens saw a faster rate of decline during the month.

What makes Malaysia and India more creditor friendly than the Philippines?

The Philippines is ‘unpredictable’ in enforcement of laws and resolution time.

Taiwanese banks’ profitability to weaken in 2026 as loans and wealth sales slow

Wealth management sales may moderate.

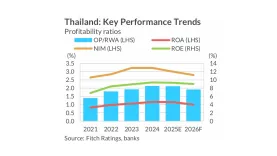

Thai banks brace for weaker 2026 earnings as rate cuts hit margins

Loan growth may pick-up but likely to stay in single digits, says Fitch.

Australia’s new mortgage caps unlikely to hit bank credit growth

The new limit may mitigate risks of significant increases in household debt.

This week in finance: CIMB Singapore's new card for sole proprietors; banks' real estate woes; in-app chat services heat up

GoTyme Bank is now compatible with Google Pay.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership